mudra.org.in Registration : Mudra Loan Scheme 2025 Apply Online. Check Eligibility, Required Documents, Condition to Get Mudra Loan

Mudra loan Scheme 2025

The Pradhan Mantri Mudra Yojana (PMMY) is a pivotal initiative by the Government of India aimed at supporting micro enterprises in the non-farm sector. This flagship scheme facilitates micro credit/loans of up to Rs. 10 lakhs for income-generating activities such as manufacturing, trading, and services, including ancillary agricultural activities like poultry, dairy, and beekeeping. Implemented through various Member Lending Institutions, PMMY targets non-corporate, non-farm sector entities, enabling small businesses across diverse sectors. These entities range from proprietorship and partnership firms to small manufacturing units, service providers, retailers, transport operators, food vendors, artisans, and more.

Overview of Pradhan Mantri Mudra Yojana (PMMY) :

| Scheme | Pradhan Mantri Mudra Yojana (PMMY) |

|---|---|

| Government Initiative | PMMY supports micro enterprises in the non-farm sector. |

| Loan Facilities | Offers loans up to Rs. 10 lakhs for activities like manufacturing, trading, services, and ancillary agriculture. |

| Implementation | Implemented through various Member Lending Institutions (MLIs). |

| Target Audience | Targets proprietorship, partnership firms, small manufacturing units, service providers, retailers, transport operators, food vendors, artisans, etc. in the non-corporate, non-farm sector. |

| Official Website | mudra.org.in |

Benefits of PMMY :

- The scheme categorizes loans into three segments: ‘SHISHU’, ‘KISHORE’, and ‘TARUN’, based on the growth stage and funding requirements of micro units and entrepreneurs.

- Shishu : Covers loans up to Rs. 50,000.

- Kishore : Covers loans above Rs. 50,000 and up to Rs. 5 lakhs.

- Tarun : Covers loans above Rs. 5 lakhs and up to Rs. 10 lakhs.

Eligibility Criteria :

Eligible Borrowers :

- Individuals

- Proprietary concerns

- Partnership firms

- Private Limited Companies

- Public Companies

- Any other legal entities

Notes :

Note 01 : Applicants should not have defaulted on any payments to banks or financial institutions and must maintain a satisfactory credit track record.

02: Individual borrowers should possess the requisite skills, experience, and knowledge to undertake the proposed business activity.

Note 03 : Educational qualifications, if required, are assessed based on the nature and requirements of the proposed business activity.

Eligible Member Lending Institutions (MLIs) :

Interest Rate :

- Member Lending Institutions determine interest rates periodically in accordance with Reserve Bank of India guidelines.

- Applicable interest rates are set based on these guidelines.

Upfront Fee /Processing Charges :

- Banks may apply upfront fees according to their internal policies.

- Most Banks waive upfront fees or processing charges for Shishu loans (covering loans up to Rs. 50,000/-).

Application Process for PM MUDRA Loan :

Online Application Process :

Prerequisites for Enrolment :

- ID Proof

- Address Proof

- Passport Size Photograph

- Applicant’s Signature

- Proof of Identity /Address for Business Enterprises

Steps for Application :

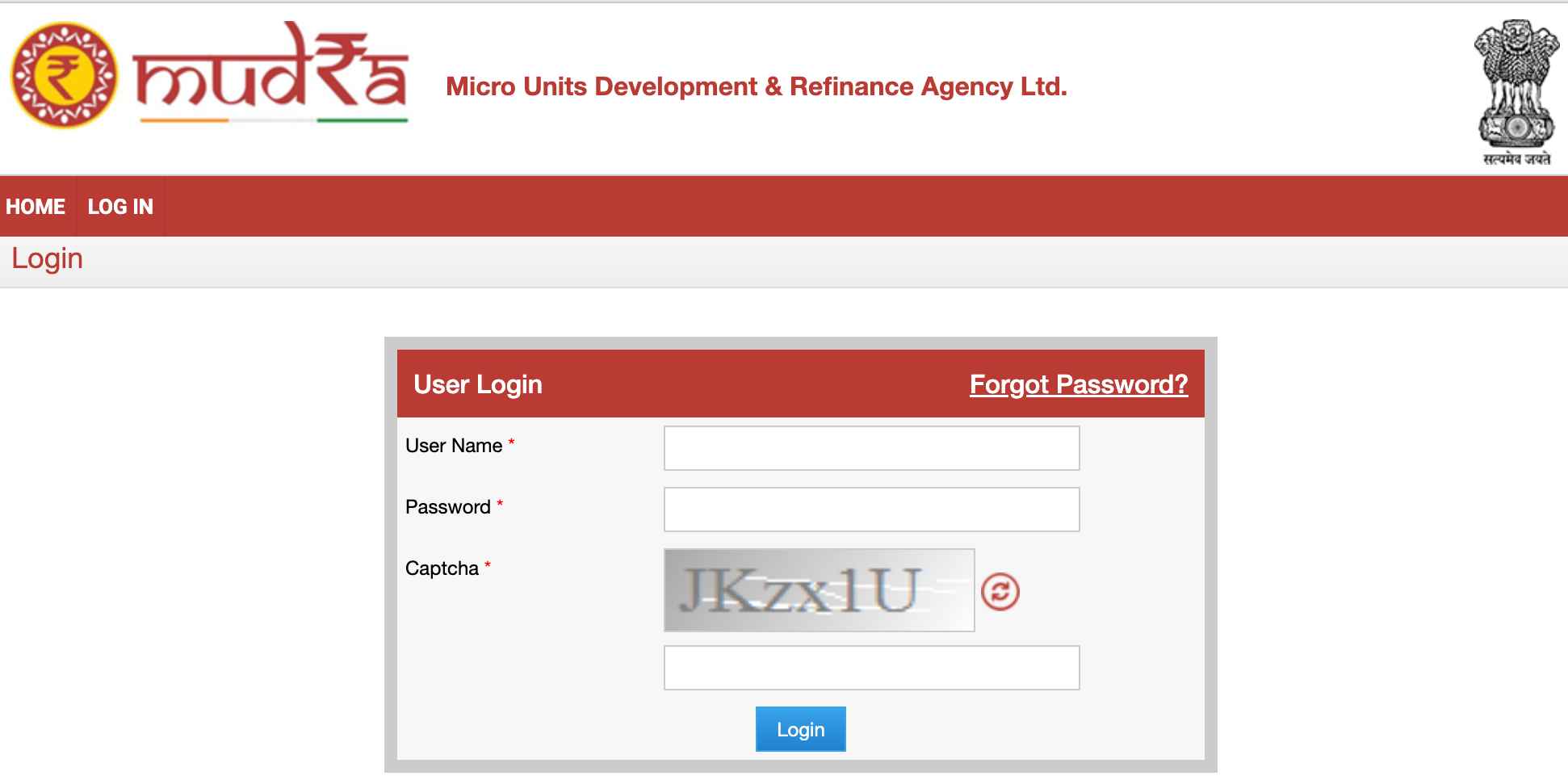

- Visit PM MUDRA Official Website and Udyamimitra Portal : Navigate to the PM MUDRA official website and access the Udyamimitra portal.

- Click on Mudra Loan “Apply Now” : Select the option to apply for a Mudra loan.

- Choose Applicant Type : Select from the options: New Entrepreneur, Existing Entrepreneur, or Self-employed Professional.

- Registration Details : Enter applicant’s name, email address, and mobile number. Generate OTP for verification.

After Successful Registration :

- Fill in Personal and Professional Details : Provide comprehensive personal and professional information.

- Select Hand-Holding Agencies :Opt for assistance from hand-holding agencies if needed for project proposal preparation, or proceed directly to the Loan Application Center.

- Choose Loan Category : Select the type of loan required: Mudra Shishu, Mudra Kishore, or Mudra Tarun.

- Provide Business Information : Enter details such as business name, activity, industry type (Manufacturing, Service, Trading, or allied agriculture activities).

- Complete Additional Information : Fill in owner details, current banking/credit facilities, proposed credit facilities, future estimates, and preferred lender information.

- Attach Required Documents : Upload necessary documents including ID proof, address proof, applicant’s photo, applicant’s signature, and proof of identity /address for the business enterprise.

- Submission and Application Number : Submit the application. An Application Number will be generated, which should be noted for future reference.

Documents Required for Shishu Loan :

Proof of Identity : Self-attested copy of Voter’s ID Card, Driving Licence, PAN Card, Aadhaar Card, Passport, or Photo IDs issued by Government authority.

Proof of Residence :

- Recent telephone bill, electricity bill, property tax receipt (not older than 2 months), Voter’s ID Card, Aadhaar Card, Passport of Individual /Proprietor/Partners.

- Bank passbook or latest account statement attested by Bank Officials.

- Domicile Certificate or Certificate issued by Government Authority, Local Panchayat, or Municipality.

Applicant’s Photograph : Two recent coloured photographs, not older than 6 months.

Quotation and Details of Purchase:

- Quotation of Machinery or other items to be purchased.

- Name of supplier, details of machinery, and price of machinery /items.

Proof of Identity /Address of Business Enterprise : Copies of relevant Licences, Registration Certificates, or other documents proving ownership and address of the business unit.

Documents Required for Kishore and Tarun Loan

Proof of Identity : Self-attested copy of Voter’s ID Card, Driving Licence, PAN Card, Aadhaar Card, Passport.

Proof of Residence : Recent telephone bill, electricity bill, property tax receipt (not older than 2 months), Voter’s ID Card, Aadhaar Card, Passport of Proprietor /Partners /Directors.

Applicant’s Photograph : Two recent coloured photographs, not older than 6 months.

Proof of Identity /Address of Business Enterprise : Copies of relevant Licences, Registration Certificates, or other documents proving ownership, identity, and address of the business unit.

Additional Requirements :

- Applicant should not be a defaulter in any Bank /Financial institution.

- Statement of accounts for the last six months from the existing banker (if any).

- Last two years’ balance sheets of the unit along with income tax/sales tax returns (applicable for amounts Rs. 2 Lakhs and above).

- Projected balance sheets for one year (for working capital limits) or for the loan period (for term loans, applicable for amounts Rs. 2 Lakhs and above).

- Sales achieved during the current financial year up to the date of application submission.

- Project report detailing technical and economic viability of the proposed project.

- Memorandum and Articles of Association of the company or Partnership Deed of Partners.

- Asset and Liability statement from the borrower, including Directors and Partners, in absence of third-party guarantee, to determine net-worth.

Eligibility Criteria :

- Indian Citizenship : Applicant must be an Indian Citizen.

- Loan Purpose :

- Business loan for Vendors, Traders, Shopkeepers, and other Service Sector activities

- Working capital loan through MUDRA Cards

- Equipment Finance for Micro Units

- Transport Vehicle loans – for commercial use only

- Loans for agri-allied non-farm income generating activities (e.g., pisciculture, beekeeping, poultry farming, etc.)

- Tractors, tillers, and two-wheelers used for commercial purposes only

- Loan Amount : Credit needed should be more than ₹10,00,000

- Credit History: Applicant should not be under any default to a Bank or to a Financial Institution

- Activity Type : Applicant must possess one of the following activity mentioned.

- Transport Vehicle (i)

- Community, Social & Personal Service Activities (i)

- Food Products Sector (i)

- Textile Products Sector / Activity (i)

- Business loans for Traders and Shopkeepers (i)

- Equipment Finance Scheme for Micro Units (i)

- Activities allied to agriculture (i)

Official Website >> mudra.org.in >> Pradhan Mantri Mudra Yojana (PMMY)

Click Here to Get Mudra Loan Online.

- Mudra loan Scheme 2025

- Benefits of PMMY :

- Eligibility Criteria :

- Eligible Borrowers :

- Notes :

- Eligible Member Lending Institutions (MLIs) :

- Interest Rate :

- Upfront Fee /Processing Charges :

- Application Process for PM MUDRA Loan :

- Online Application Process :

- Steps for Application :

- After Successful Registration :

- Documents Required for Shishu Loan :

- Documents Required for Kishore and Tarun Loan

- Additional Requirements :

- Scheme Overview :

- Target Enterprises :

- Purpose :

- Eligibility Criteria :

- Official Website >> mudra.org.in >> Pradhan Mantri Mudra Yojana (PMMY)

Visa