Ckyc Registration Online : www.ckycindia.in login, How do i Get a 14 Digit Ckyc Number

Ckyc Registration Online : www.ckycindia.in login, How do i Get a 14 Digit Ckyc Number

The term “Central Know Your Customer,” or “CKYC,” refers to the centralized database that houses KYC information for clients using a range of financial services from banks to insurance providers to non-banking financial organizations (NBFCs). Financial institutions no longer have to deal with the headache of several KYC verifications thanks to this expedited CKYC procedure, which also makes onboarding new clients easier.

The Indian government has made financial transactions more efficient and convenient by introducing CKYC, which tackles the typical annoyance of having to submit the same KYC documentation every time someone opens a new bank account or invests in a mutual fund.

CKYC India – Completing Central KYC and Checking Your CKYC Number

What is CKYC ?

CKYC means Central Know Your Customer. It is a centralized database for KYC information in the financial sector. This system helps reduce the need to submit KYC documents multiple times when starting new financial relationships. Once you finish the process, you will receive a unique 14-digit CKYC number that makes future transactions with participating institutions easier.

Background of CKYC :

CKYC was created under Section 73 of the Prevention of Money Laundering Act, 2002. The aim is to fight against black money by ensuring that individuals have one KYC record for their financial transactions. The Central Registry of Securitisation Asset Reconstruction and Security Interest (CERSAI) manages this system.

Features of CKYC :

You get a unique 14-digit CKYC number linked to your ID. Your customer data is stored securely in electronic form. The submitted documents are verified with the authorities that issued them. Any updates to your KYC are communicated to relevant institutions.

How CKYC Works ?

CKYC is important for stock market and mutual fund investors. When you invest, you need to submit KYC forms and documents to the fund house. These documents are then sent to CERSAI, which issues your CKYC number. For future investments, just give your CKYC number, and you won’t need to submit documents again.

Which Institutions Can Register Customers for CKYC ?

Only financial institutions regulated by SEBI, RBI, IRDAI, and PFRDA can register KYC details. This applies when opening bank accounts, Demat accounts, buying insurance, or investing in mutual funds.

Validity of CKYC :

- Lifetime Validity: Once you register, your CKYC lasts forever.

- Update Anytime: You can change your CKYC status online whenever you need to.

- Streamlined Process: CKYC makes investment easier for both investors and financial institutions, helping more people get involved in the market.

Differences Between Normal KYC, eKYC, and CKYC :

| Type of KYC | Description |

|---|---|

| Normal KYC | Traditional method requiring in-person visits to submit documents. |

| eKYC | Digital submission of personal information and ID documents through mobile apps or websites. |

| CKYC | A centralized database managed by the Indian government, reducing the need for repeated submissions to different financial institutions. |

Benefits of CKYC :

- Streamlined Verification: Reduces how often individuals need to submit their information.

- Improved Security: Centralizing data helps find and prevent fraud.

- Reduced Paperwork: No need to send multiple copies of KYC documents to different places.

- Enhanced Customer Experience: Saves time and effort by avoiding repeated information submissions.

- Improved Data Management: Makes it easier for financial institutions to access and manage customer info, boosting efficiency.

Impact on Existing Investors :

- Current Status: Existing investors don’t have to go through the CKYC process right now, but this might change later.

- Value of CKYC: Aims to make onboarding new investors easier while protecting customers and financial institutions.

- Potential Benefits: Simplifying the system could lead to more people participating in finance, benefiting everyone involved.

How to Complete the CKYC Process ?

- Find a participating institution like a bank or insurance company.

- Submit required documents such as your PAN card, Aadhaar card, and proof of address.

- The institution verifies these documents with the issuing authorities.

- You will receive your CKYC number once verification is successful.

How to Check CKYC Number ?

a. To check your CKYC number, go to Karvy KRA or CDSL.

b. Enter your PAN number and the security code.

c. Your CKYC number and details will be shown, and you may download the report if it’s available.

Documents Required for CKYC :

- Proof of Identity (POI)

- Proof of Address (POA)

- Passport-sized photograph

- Signature

Is CKYC Mandatory ?

Yes, financial institutions under SEBI, RBI, IRDAI, or PFRDA must register customers through CKYC.

Impact on Existing Mutual Fund Investors :

Current investors do not need to complete CKYC again unless they decide to invest with a new mutual fund house, in which case they will need it.

OFFICIAL WEBSITE << ckycindia.in >> CKYC India

CLICK HERE to check the status of CYKC Application.

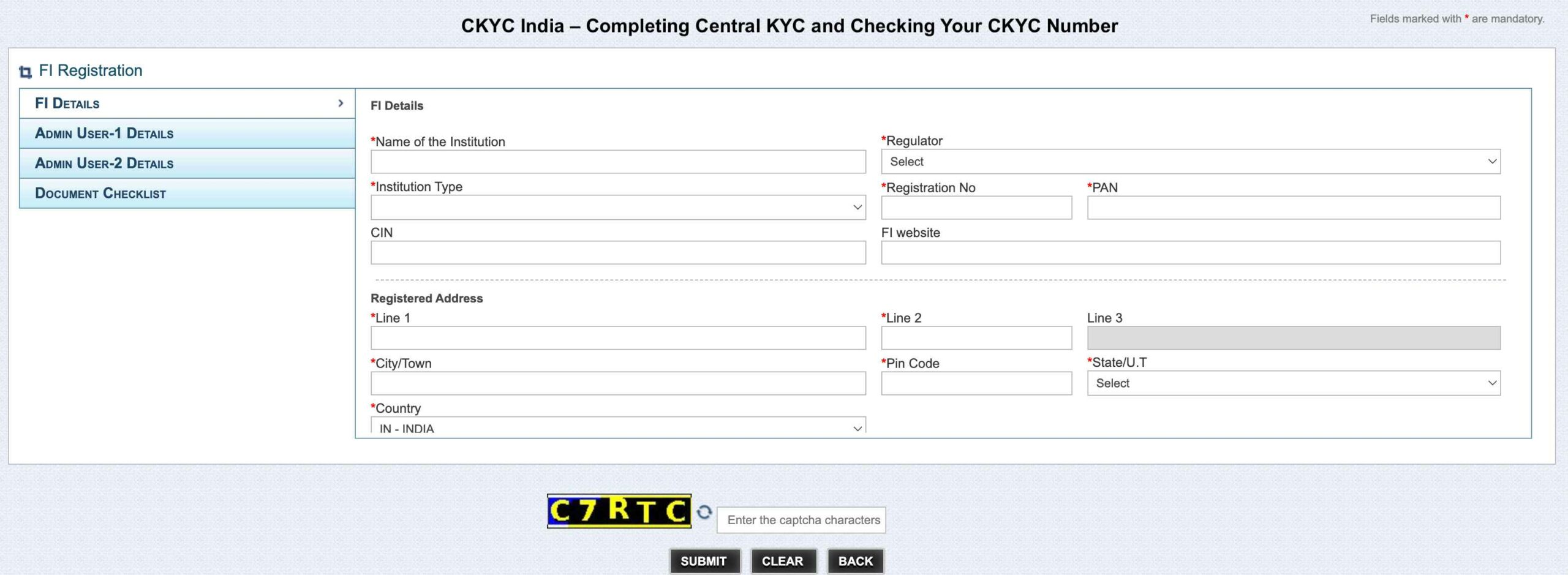

CLICK HERE for new CKYC Institute Registration.

To download the PDF of FI registration form for CKYC – Click Here

- CKYC Registration Online :

- Ckyc Registration Online : www.ckycindia.in login, How do i Get a 14 Digit Ckyc Number

- CKYC Registration Online

- CKYC India – Completing Central KYC and Checking Your CKYC Number

- What is CKYC ?

- Background of CKYC :

- Features of CKYC :

- How CKYC Works ?

- Which Institutions Can Register Customers for CKYC ?

- Types of CKYC accounts :

- Validity of CKYC :

- Benefits of CKYC :

- Impact on Existing Investors :

- How to Complete the CKYC Process ?

- How to Check CKYC Number ?

- Documents Required for CKYC :

- Is CKYC Mandatory ?

- OFFICIAL WEBSITE << ckycindia.in >> CKYC India