New Pension Scheme Official Website – How to Apply : New Unified Pension Scheme (UPS) Registration (Hindi) Portal : what is Ups Scheme. Check Beneficiary List

Old vs New ] Ups Pension Scheme Retirement, Calculator, Scheme for Govt Employees Details pdf

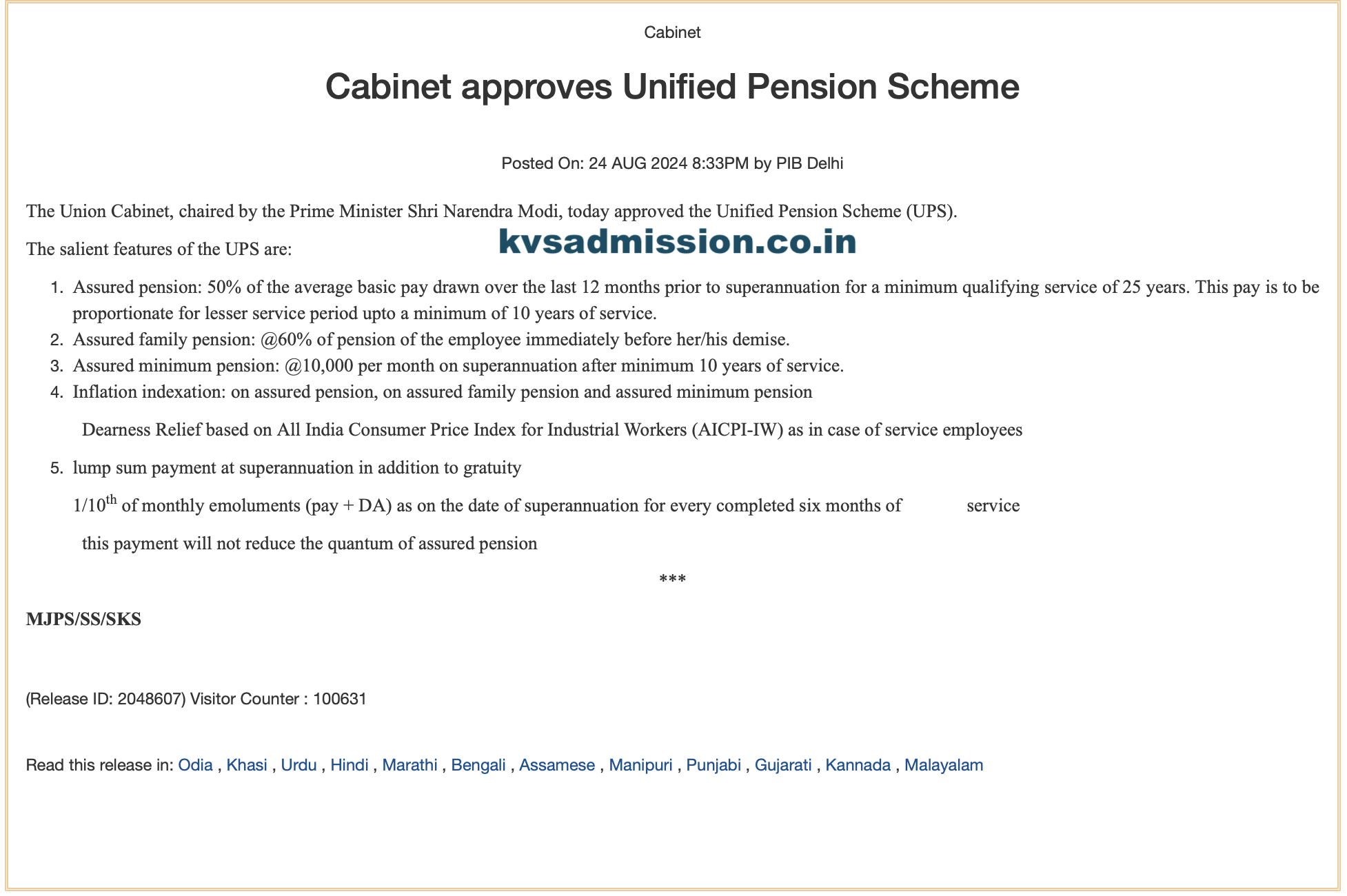

During the time of the ongoing peak discussion regarding pension schemes, the central government has introduced the Unified Pension Scheme (UPS). Central Minister Ashwini Vaishnav explained the criteria for central employees to benefit financially from this initiative. During a cabinet meeting on Saturday, significant announcements were made, with the Unified Pension Scheme standing out. One of the main aspects of UPS is that, like the Old Pension Scheme (OPS), government employees will receive 50% of their average basic salary at retirement. However, this will governed by specific standards and regulations. Read the complete article for comprehensive details regarding UPS Scheme.

The Union Cabinet has given the green light to the Unified Pension Scheme (UPS), which will take the place of the National Pension System (NPS). This new scheme is set to launch on April 1, 2025, with the potential to benefit approximately 23 lakh central government employees. The UPS will offer a guaranteed pension amounting to 50% of the average basic pay from the last 12 months before retirement, especially advantageous for those who have served for at least 25 years. The following sections outline the main features of the UPS Pension Scheme, the eligibility requirements, how the pension amount is calculated, and the differences between this new scheme and the previous pension system.

Unified Pension Scheme (UPS) – Key Features and Updates :

Announcement of UPS: In response to discussions on old versus new pension plans, the central government has introduced the Unified Pension Scheme (UPS). Central Minister Ashwini Vaishnav explained the financial benefits and eligibility criteria for central employees under this new scheme.

Key Features of UPS :

- 50% Pension Guarantee: Retiring employees will receive 50% of their average basic salary from the last year as their pension. This mirrors the Old Pension Scheme (OPS). Employees with up to 25 years of service will qualify for this benefit; those with between 10 and 25 years will receive a proportionate pension.

- Family Pension: If an employee passes away, their family will get 60% of the pension amount.

- Minimum Pension: Employees with at least 10 years of service are guaranteed a minimum pension of ₹10,000 per month. Adjusted for inflation, this figure is roughly ₹15,000 today.

- Inflation Indexation: All pension types—guaranteed, family, and minimum—will adjusted according to inflation rates through Dearness Relief (DR).

- Lump Sum Payment at Retirement: Upon retirement, employees will receive a one-time payment equal to 10% of six months’ worth of basic salary plus Dearness Allowance (DA) for each six-month service period. For instance, someone with 30 years of service will receive a lump sum based on their salary for six months and DA.

Old Pension Scheme vs. Unified Pension Scheme :

| Old Pension Scheme | Unified Pension Scheme | |

| Pension Calculation | 50% of the final salary | 50% of the average basic pay from the last year |

| Employee Contribution | No contribution required | 10% of basic pay and Dearness Allowance (DA) |

| Government Contribution | Fully funded by the government | Government contributes up to 18.5% |

| Minimum Pension Guarantee | No minimum guarantee | Minimum pension guaranteed at ₹10,000 per month |

| Family Pension | Spouse receives 50% of the pension after the pensioner’s death | Family receives 60% of the pension after the pensioner’s death |

| Inflation Indexation | Adjusted for inflation through DA | Also adjusted for inflation through DA |

| Lump Sum Payment | No lump sum option | Offers a lump sum payment based on length of service |

| Sustainability | Considered unsustainable due to increasing liabilities | More sustainable due to its contribution-based structure |

Implementation and Benefits :

- Effective Date: The UPS will come into effect on April 1, 2025.

- Scope: This scheme is designed to benefit 2.3 million central government employees, who can either stick with the National Pension Scheme (NPS) or switch to UPS. If state governments adopt the plan, it could potentially cover up to 9 million employees.

- Increased Government Contribution: The central government’s contribution will increase to 18.5% of employees’ basic salary, up from 14%. This adjustment means that employees will not face any additional burden.

UPS Pension Scheme – Benefits and Drawbacks :

- The new Unified Pension Scheme (UPS) will start on April 1, 2025.

- It will support 2.3 million employees who retired after 2004.

- Employees can choose between the current National Pension Scheme (NPS) and the new UPS.

- Up to ₹800 crore will set aside for paying arrears.

Pension Amount Details :

- Employees with 25 years of service will receive 50% of their average basic salary from the last 12 months as their pension.

- Those with 10 to 25 years of service will have their pension calculated based on their years of service.

Family Benefits :

- If an employee passes away, their family will receive 60% of the pension amount, providing them with financial support.

UPS for Lower Salary Employees :

1. Minimum Pension Guarantee : The new scheme ensures a minimum pension of ₹10,000 per month after retirement, offering financial stability against inflation and uncertainties for employees with lower salaries. This benefit applies only to those who have worked for at least 10 years.

2. Less than 10 Years of Service : Employees who leave before reaching 10 years of service will not qualify for any pension.

3. Comparison with Previous Scheme Previous Pension Scheme Contributions : In the earlier scheme, employees paid 10% of their basic salary, while the government’s contribution was 14%.

4. New Scheme Contributions : Under the new UPS, employees will still contribute 10% of their basic salary, but the government will raise its contribution to 18.5% of the employee’s basic salary.

5. Additional Benefits of UPS Inflation Indexation : Employees will get Dearness Relief (DR) based on the All India Consumer Price Index for Industrial Workers (AICPI-W), ensuring adjustments for inflation.

6. Lump Sum Amount at Retirement : Besides gratuity, employees will receive a lump sum at retirement, calculated as one-tenth of the total of their basic salary and Dearness Allowance (DA) for every 6 months of service.

Pension Calculation Under UPS :

- Employees with a minimum of 25 years of service will receive 50% of their average basic pay from the final 12 months before they retire. For those who have worked between 10 and 25 years, the pension amount will adjusted accordingly.

- Employees with at least 10 years of service are guaranteed a minimum pension of ₹10,000 per month.

Eligibility for UPS Benefits :

- Employees who retired between 2004 and March 31, 2025, as well as those retiring by that date, can access the benefits of the UPS. These individuals will also receive retroactive payments calculated based on the new scheme.

- ₹800 crore has been allocated for these retroactive payments. The scheme is fully funded, and an additional ₹6,250 crore will provided each year to cover the government’s increased contributions to pensions.

Calculation of Retroactive Payments :

- According to Finance Secretary Dr. TV Somanathan, the period from 2004 to now spans 20 years, during which there have been relatively few retirees under the National Pension Scheme (NPS). Complete records exist for these retirees detailing their service dates and received amounts. If they choose to switch to UPS, they will entitled to retroactive payments with interest based on these records.

Inflation Adjustment with UPS :

- The UPS accounts for inflation by providing adjustments for the guaranteed pension, family pension, and minimum pension. Dearness Relief (DR) will revised in line with the All India Consumer Price Index for Industrial Workers (AICPI-IW), similar to ongoing adjustments for current employees.

Additional Payments at Retirement :

- Aside from gratuity, employees will also receive a lump-sum payment upon retirement. This payment amounts to one-tenth of the monthly emolument (basic pay + Dearness Allowance) for every six months of completed service. This lump-sum is distinct from the guaranteed pension and does not influence its amount.

Unified Pension Scheme (UPS) – Special Features :

The Unified Pension Scheme (UPS), also known as the Integrated Pension Scheme, includes several important features :

- Pension Calculation: Employees with a minimum of 25 years of service will receive 50% of their average basic pay from the last year before retirement as their pension.

- Pension for 25 Years of Service: Those completing 25 years of service are eligible for the full pension amount.

- Choice of Scheme: Central Government employees can choose between the National Pension System (NPS) and UPS.

- Eligibility for Pension: A minimum of 10 years of service is required for employees to qualify for UPS benefits.

- Minimum Pension: Employees retiring after at least 10 years of service will receive a minimum pension of ₹10,000 each month.

- Family Pension: If an employee passes away, their family will receive 60% of the pension the employee was receiving.

- Inflation Indexation: Pension amounts will adjusted according to inflation.

- Additional Lump Sum Payment: Employees will also receive a lump-sum payment at retirement, calculated as one-tenth of their monthly salary (including basic pay and Dearness Allowance) for every six months of service.

- Government Contribution: Employees are not required to make extra contributions, as the government will contribute 18.5% of the employee’s basic salary.

Official Website for Unified Pension Scheme (UPS) 2024

- Old vs New ] Ups Pension Scheme Retirement, Calculator, Scheme for Govt Employees Details pdf

- Unified Pension Scheme (UPS) – Key Features and Updates :

- Old Pension Scheme vs. Unified Pension Scheme :

- Implementation and Benefits :

- UPS Pension Scheme – Benefits and Drawbacks :

- Pension Amount Details :

- Family Benefits :

- UPS for Lower Salary Employees :

- Pension Calculation Under UPS :

- Eligibility for UPS Benefits :

- Calculation of Retroactive Payments :

- Inflation Adjustment with UPS :

- Additional Payments at Retirement :

- Unified Pension Scheme (UPS) – Special Features :

- Official Website for Unified Pension Scheme (UPS) 2024