Official Web portal : pmfme.mofpi.gov.in Pmfme loan Govt Scheme Apply (Online Application), Subsidy 59 Minutes Loan, Pm Fme loan Application Form Get Now. PM Formalisation of Micro Food Processing Enterprises Scheme

pmfme.mofpi.gov.in Pmfme loan Govt Scheme Apply (Online Application), Subsidy

The Indian food processing industry is highly diverse, catering to a wide range of food products. There are approximately 25 lakh food processing units operating within the unorganised sector, which account for 74% of employment in this industry. Despite their significant contribution, these unorganised sectors have long faced numerous challenges.

To address these issues, the Government of India, through the Ministry of Food Processing Industry (MoFPI), launched the Pradhan Mantri Formalisation of Micro Food Processing Enterprises (PMFME) scheme. This initiative aims to support and formalise the unorganised food processing sector. Continue reading to learn more about the PMFME scheme, including its benefits, eligibility criteria, and other essential details.

Salient Features of the Scheme :

Common Infrastructure :

- Target groups: FPOs, FPCs, Cooperatives, SHG federations, Government Agencies.

- Purpose: Establish or enhance food processing lines with common infrastructure, value chains, or incubation centres.

- Subsidy: Credit-linked capital subsidy at 35% of the eligible project cost (up to Rs. 10 Crore), with a maximum subsidy of Rs. 3 Crore.

Credit Linked Subsidy :

- Eligible entities: Individuals, proprietorships, partnerships, FPOs, NGOs, cooperatives, SHGs, Pvt. Ltd. companies.

- Purpose: Upgrade existing units or set up new ones.

- Subsidy: Credit-linked capital subsidy at 35% of the eligible project cost, with a maximum of Rs. 10 Lakhs per unit.

ODOP (One District One Product) :

- Aim: Leverage scale benefits in procurement, common services, and product marketing.

- Scope: Framework for value chain development and support infrastructure alignment.

- Coverage: Approved for 713 districts across 35 States/UTs, featuring 137 unique products.

Seed Capital for SHGs :

- Purpose: Provide working capital and funds for small tools.

- Subsidy: Seed capital at Rs. 40,000 per SHG member, up to Rs. 4 Lakhs per SHG.

- Distribution: Given as a grant to the SHG Federation by SRLM/SULM through SNA for loans to SHG members.

Marketing & Branding :

- Support: 50% financial grant for branding and marketing.

- Beneficiaries: Groups of FPOs, SHGs, cooperatives, or SPVs of micro food processing enterprises.

- Objective: Promote existing or proposed brands and market processed food products.

Capacity Building :

- Focus : Training on Food Processing Entrepreneurship Development Programme.

- Beneficiaries : PMFME scheme participants.

PMFME Application Form :

Application Methods : Apply online or offline.

Offline Forms :

- Farmer Producer Companies (FPC)

- Cooperative societies

- Common infrastructure

- Self-Help Groups (SHGs)

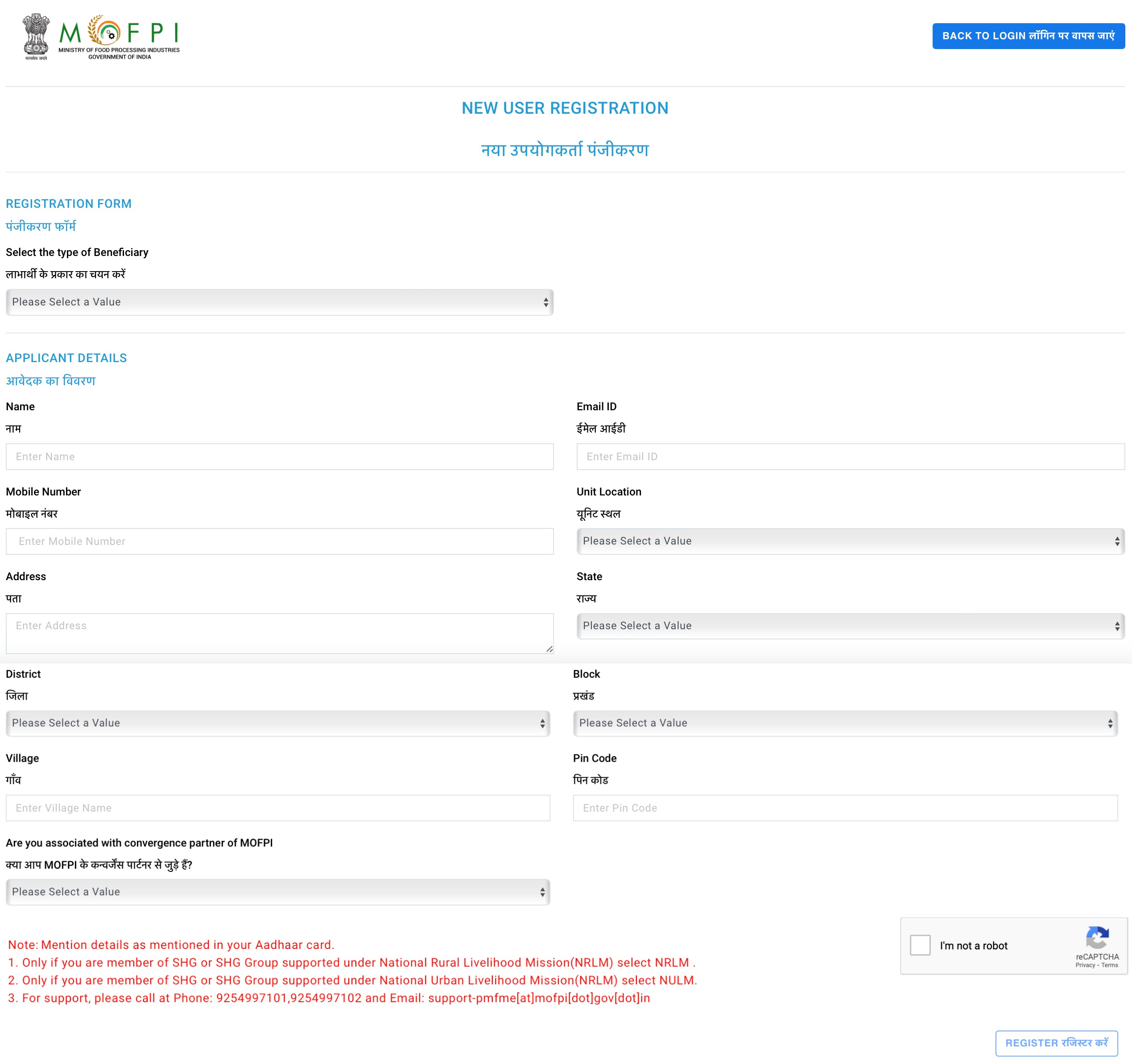

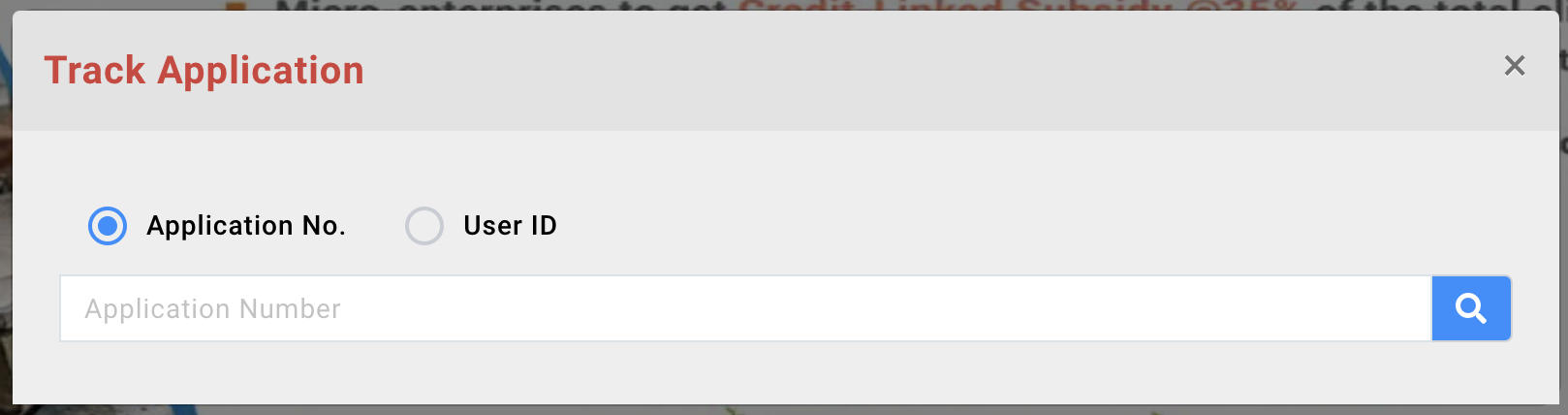

Online Application Process :

- Visit the official PMFME website – pmfme.mofpi.gov.in

- Click on ‘Login’ and then ‘Applicant Registration‘.

- Enter the required details and click ‘Register’.

- Log in by selecting ‘Login’ and ‘Applicant Login’.

- Enter User ID and password, then click ‘Submit’.

- From the dashboard, choose ‘Apply Online’.

- Complete the applicable form with all necessary details and click ‘Submit’.

2. Branding and Marketing

Eligibility Criteria :

- The branding and marketing proposal should be related to ODOP.

- The minimum turnover of the product should be Rs. 5 crore.

- The final product should be sold to consumers in retail packs.

- Products and producers should be scalable to larger levels.

- The entity should possess management and entrepreneurship capabilities for promotion.

4. Food Processing Units :

Eligibility Criteria :

- Individuals or partnership firms with ownership rights of the enterprise are eligible.

- Existing micro food processing units in operations are eligible.

- Existing micro food processing units verified by the resource person are eligible.

- Applicants should be above 18 years old and possess at least VIII standard pass educational qualification.

- Only one person from one family is eligible for financial assistance, including self, spouse, and children.

5. Seed Capital for SHGs :

Eligibility Criteria :

- Only SHG members currently engaged in food processing are eligible.

- SHG members must commit to utilizing the amount for working capital and purchasing small tools and make a commitment to the SHG federation and SHG.

| Seed Capital for SHGs | |

|---|---|

| Support for | – Members of SHGs engaged in food processing |

| Uses | – Purchase of small tools |

| – Working capital | |

| Financial Support | – Provided at the federation level of SHGs |

| – Extended as loans to members through SHGs | |

PMFME Scheme Details :

- Full Form : Pradhan Mantri Formalisation of Micro Food Processing Enterprises (PMFME) scheme.

- Purpose : A one-stop solution to formalize the Indian food sector.

- Implementing Ministry : Ministry of Food Processing.

- Objective : Supports the ‘Vocal for Local’ campaign.

- Launched under Atmanirbhar Bharat Abhiyaan in 2020.

- Duration : 5 years (2020-21 to 2024-25).

- Increase and formalize micro-enterprises in the food processing sector.

- Special support for Farmer Producer Organizations (FPOs), producer cooperatives, and Self-Help Groups (SHGs).

- Centrally sponsored with an outlay of Rs. 10,000 crores over 5 years.

- 60:40 ratio between central and state governments.

- 90:10 ratio in North-Eastern and Himalayan states.

- pmfme.mofpi.gov.in Pmfme loan Govt Scheme Apply (Online Application), Subsidy

- Salient Features of the Scheme :

- Common Infrastructure :

- Credit Linked Subsidy :

- ODOP (One District One Product) :

- Seed Capital for SHGs :

- Marketing & Branding :

- Capacity Building :

- PMFME Application Form :

- Application Methods : Apply online or offline.

- Offline Forms :

- Online Application Process :

- PMFME Scheme List :

- 1. Common Infrastructure Development :

- 2. Branding and Marketing

- 3. Capacity Building and Research :

- 5. Seed Capital for SHGs :

- PMFME Scheme Details :

- OFFICIAL WEBSITE >> PMFME >> pmfme.mofpi.gov.in

Home loan

I need 200000 lakh loan

ha Apply kare aur sath me AIF ka bhi labh le, Agar Gujarat ke honge to handhold support bhi kar dunga.

Ajay Kumar Sharma

SPMU, Gujarat

I need 200000 loan

Thank you

I m private job employee

Need loan for business.