Official Website : kviconline.gov.in Pmegp Online Application Portal, Subsidy Claim, E Portal Kvic login, Eligibility Criteria : www.kvic.org.in Application Status Check 2024.

Pmegp Online Application Portal, Subsidy Claim

The Prime Minister’s Employment Generation Programme (PMEGP) is designed to create employment opportunities by supporting the establishment of new self-employment ventures, projects, or micro-enterprises in both rural and urban areas. Under this scheme, beneficiaries receive a subsidy covering 15% to 35% of the project cost, depending on their category and location.

Beneficiaries are required to contribute between 5% and 10% of the project cost themselves, while the remaining amount is financed through banks. Additionally, the PMEGP scheme provides an opportunity for well-performing units, including those under PMEGP or MUDRA, to apply for a second loan aimed at expanding or upgrading their existing or related activities.

PMEGP Scheme Overview :

| Name | Prime Minister’s Employment Generation Programme (PMEGP) |

|---|---|

| Administered by | Union Ministry of Micro, Small and Medium Enterprises (MoMSME) |

| Objective | To foster self-employment opportunities in rural and urban areas by providing credit-linked subsidies to new self-employment ventures, micro-enterprises, and projects. |

| Margin Money Subsidy | Manufacturing Units: Up to 35% subsidy for projects up to ₹50 lakh. Service Units: Up to 35% subsidy for projects up to ₹20 lakh. |

| For Projects Exceeding Limits | Projects exceeding ₹50 lakh (manufacturing) and ₹20 lakh (services) can avail balance credit from banks without government subsidy. |

For Projects Exceeding Limits:

Projects exceeding ₹50 lakh (manufacturing) and ₹20 lakh (services) can avail balance credit from banks without government subsidy.

Second Loan Details :

Eligible Project Costs :

- Manufacturing Segment : Up to ₹1 crore.

- Service Segment : Up to ₹25 lakh.

Maximum Subsidy for Second Loans :

- Manufacturing Units : ₹15 lakh (₹20 lakh for North East Region and Hill States).

- Service Units : ₹3.75 lakh (₹5 lakh for North East Region and Hill States).

For Projects Exceeding Second Loan Limits :

- Projects exceeding ₹1 crore (manufacturing) and ₹25 lakh (services) can avail balance credit from banks without government subsidy.

Implementation:

- National Level: Administered by Khadi and Village Industries Commission (KVIC).

- State Level: Implemented through State Khadi and Village Industries Boards (KVIBs), State offices of KVIC, Coir Board (for coir activities), District Industries Centres (DICs), and banks.

Subsidy Disbursement :

- Margin money subsidy is routed from KVIC to the financing bank’s branches via a nodal bank.

- The financing bank credits the subsidy to the borrower’s account after the lock-in period, based on the physical verification report.

Project Cost Limits for PMEGP Subsidy :

| Sector | Maximum Project Cost Allowed for New Enterprises | Maximum Project Cost Allowed for Existing Units (2nd Loan for Upgradation) |

|---|---|---|

| Manufacturing | ₹50 lakhs | ₹1 crore |

| Business/Service | ₹20 lakhs | ₹25 lakhs |

Margin Money Subsidy Details :

Margin Money Subsidy Overview :

- One-Time Assistance: Margin money (subsidy) is provided as a one-time assistance and is not available for credit limit enhancement, modernization, or expansion of the project, except for upgradation through a second loan under this scheme.

- Registration Requirement: PMEGP units must registered under the Udyam Portal before margin money can adjusted in the loan account.

- Ineligibility: Projects financed jointly by two different banks or financial institutions are not eligible for margin money assistance.

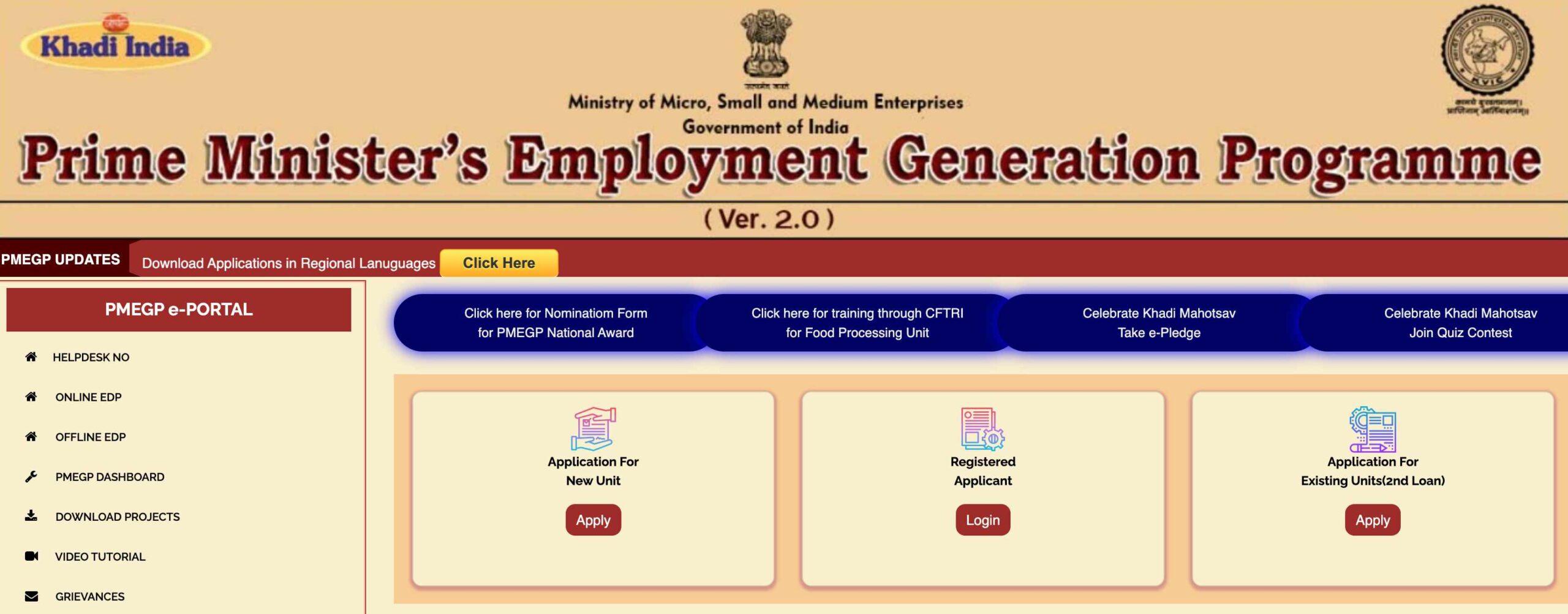

How to Apply for PMEGP Loan Online ?

- Visit the PMEGP Portal : Go to PMEGP Portal.

- Fill Out the Application Form :

- Complete the online application form and save your data.

- After saving, you will receive a username and password on your registered mobile number.

- Use these credentials to track the status of your application.

- Upload Required Documents :

- Caste Certificate

- Special Category Certificate (if applicable)

- Project Report

- Rural Area Certificate

- Education/EDP/Skill Development Training Certificate

- Any other applicable documents

- Submit the Application :

- Submit the form online. A unique Application ID will sent to your registered email ID.

- Your application and documents will electronically forwarded to the representatives of the preferred Implementing Agency (IA).

- Post-Submission :

- Within 5 working days, the nodal officer from KVIC, State KVIB, DIC, or other IAs will contact you for preliminary scrutiny.

- Submit your own contribution, EDP training certificate, photo, and Aadhaar number to the Financing Bank within 30 working days of receiving the loan sanction communication.

- The EDP certificate will uploaded by the training institute.

PMEGP Loan Eligibility Criteria :

For New Enterprises (Units) :

- Minimum Age : Must above 18 years.

- Income Criteria : No specific income criteria required for setting up projects.

- Educational Qualification : Individual entrepreneurs must have at least VIII standard education for projects costing over Rs 10 lakh in the manufacturing sector and over Rs 5 lakh in the service or business sector.

- Project Eligibility : Applicable to new viable microenterprises and village industries projects, excluding those prohibited by local authorities due to environmental or socio-economic reasons and activities listed in the negative list of the guidelines.

- Exclusions : Existing units and those that have previously availed any Government subsidy (e.g., PMRY, REGP, CMEGP, PMEGP, or other government schemes) are not eligible. Projects without capital expenditure (term loan) are not eligible.

- Project Costs : Cost of land is not included. Cost of pre-built shed and long-term lease/rental for workshed/workshop can included but only for up to 3 years.

- Application Processing : Applications can processed by Implementing Agencies (KVIB, DIC, KVIC, Coir Board) in both rural and urban areas.

- Aadhaar Requirement : Applicant must have a valid Aadhaar number and consent to authenticate demographic details from UIDAI.

- Family Eligibility : Only one person per family (including self and spouse) is eligible for the PMEGP loan.

For Upgradation of Existing PMEGP /REGP /MUDRA Units :

- Margin Money Adjustment : Subsidy must successfully adjusted after the 3-year lock-in period.

- Loan Repayment : The first loan under PMEGP, REGP, or MUDRA must fully repaid on time.

- Application Options : Beneficiary can apply for a second PMEGP loan from the same financing bank or any other willing bank.

- Profitability : The unit must have been profitable for the last 3 years and show potential for further growth through modernization or technology upgrade.

- Registration Requirement : UdyogAadhaar Memorandum (UAM) registration is mandatory.

- Employment Generation : The second loan should aim to generate additional employment.

Documents Required for PMEGP Loan :

For Setting Up New Enterprises

- Passport size photo

- Project report summary or detailed project report

- Highest educational qualification certificate

- Rural area certificate. Social or special category certificate

For Existing PMEGP /REGP /MUDRA Units (2nd Loan for Upgradation) :

- Previous Loan Documentation : Previous loan sanction letter issued by the bank. Proof of money margin claims adjusted against the previous loan. Bank certificate for full loan repayment

- Project Documentation : Project report for expansion or upgrading the unit

- Personal Identification: Passport size photo

- Financial Records: Last 3 years IT returns. Last 3 years annual accounts certified by a Chartered Accountant

EDP Training :

- Mandatory Training : EDP training is required to claim margin money through the PMEGP e-portal.

- For Projects Above Rs 5 Lakhs: 10 working days of EDP training are required.

- For Projects Up to Rs 5 Lakhs: 5 working days of EDP training are required.

- For Projects Up to Rs 2 Lakhs: EDP training is not compulsory.

- Training Components :

- Interaction with successful rural entrepreneurs

- Meetings with banks

- Field visits

- Online Training : KVIC offers a free 2-day EDP training module for prospective entrepreneurs.

- Exemption : Applicants with previous training of:

- Minimum 60 hours (online mode)

- Minimum 10 days (offline mode)

- Under EDP, ESDP, SDP, or VT

- Are exempt from undergoing EDP training again.

Rate of Subsidy for Setting Up New Enterprises :

Special Categories include: ST /SC /OBC /Minorities, Ex-servicemen, Physically handicapped, Aspiration Districts, NER, Women /Transgender, Hill and Border areas, etc.

| Beneficiary’s Contribution | Rate of Margin Money Subsidy |

|---|---|

| General Category | 10% |

| Special Categories | 5% |

Rate of Subsidy for Existing PMEGP /REGP /MUDRA Units (2nd Loan for Upgradation) :

| Beneficiary’s Contribution | Rate of Margin Money Subsidy |

|---|---|

| All Categories | 10% |

Activities Not Allowed Under PMEGP Scheme – Negative List :

- Prohibited Industries / Businesses :

- Meat Industry : Any industry or business connected with meat (processing, canning, serving as food).

- Intoxicants : Production/manufacturing or sale of intoxicants like cigars, beedis, pan, cigarettes.

- Liquor : Hotels, dhabas, or sales outlets serving liquor.

- Tobacco : Preparation or production of tobacco as raw materials.

- Toddy Tapping : Tapping of toddy for sale.

(Note: Serving or selling non-vegetarian food at hotels or dhabas allowed.)

- Environmental / Socioeconomic Prohibitions:

- Plastic Bags : Manufacturing of polythene carry bags less than 75 microns in thickness and recycled plastic bags for food or other items, which cause environmental issues.

- Cultivation and Plantations :

- Crop Cultivation : Industries related to the cultivation of crops like tea, coffee, rubber, horticulture, floriculture, animal husbandry, and sericulture are not allowed.

- Value Addition : Value addition in these categories allowed.

- Farm-Linked Activities : Off-farm or farm-linked activities in connection with horticulture, sericulture, and floriculture are permitted.

- Animal Husbandry Allowed:

- Dairy : Milk and dairy products from cows, sheep, goats, horses, camels, buffaloes, and donkeys.

- Poultry : Birds kept for eggs and meat, including turkeys, geese, chickens, and ducks.

- Aquaculture : Farming of aquatic organisms like molluscs, crustaceans, fish, and aquatic plants.

- Insects : Bees and sericulture (cocoon rearing).

OFFICIAL WEBSITE >> kviconline.gov.in >> Prime Minister’s Employment Generation Programme (PMEGP)

Click Here to Access Pmegp | Khadi | KVIC | Village Industries Portal.

CLICK HERE – to access the PMEGPs User Manual.

- Pmegp Online Application Portal, Subsidy Claim

- PMEGP Scheme Overview :

- Second Loan Details :

- Project Cost Limits for PMEGP Subsidy :

- How to Apply for PMEGP Loan Online ?

- PMEGP Loan Eligibility Criteria :

- For New Enterprises (Units) :

- For Upgradation of Existing PMEGP /REGP /MUDRA Units :

- Documents Required for PMEGP Loan :

- For Setting Up New Enterprises

- For Existing PMEGP /REGP /MUDRA Units (2nd Loan for Upgradation) :

- EDP Training :

- Rate of Subsidy for Setting Up New Enterprises :

- Rate of Subsidy for Existing PMEGP /REGP /MUDRA Units (2nd Loan for Upgradation) :

- Activities Not Allowed Under PMEGP Scheme – Negative List :

- OFFICIAL WEBSITE >> kviconline.gov.in >> Prime Minister’s Employment Generation Programme (PMEGP)