[e-district] e pauti Odisha Farmer Registration Form 2025 : samsodisha.gov.in Odisha One Portal, odishalandrevenue.nic.in

e Pauti Odisha Farmer Registration Form 2025

The Odisha Land Revenue Department’s official website, accessible at odishalandrevenue.nic.in, serves as a comprehensive platform providing vital information and services related to land and revenue matters in the state of Odisha, India. This website plays a crucial role in facilitating seamless access to various services offered by the department, catering to the needs of citizens, landowners, and stakeholders involved in land administration. Here’s a detailed overview of what you can expect to find and utilize on the Odisha Land Revenue Department’s website:

Online Land Revenue Payment (e-Pauti) – Objective :

1. The primary aim of this application is to offer a convenient online platform for individuals to make their land revenue payments.

2. Users can pay their “Khajana” and instantly download the receipt online.

3. Additionally, if a receipt is lost, users can easily retrieve their transaction details and download the receipt again.

Home Page Options :

- Pay Land Revenue: Initiate payments for land revenue.

- Download Rent Receipt: Obtain receipts for past transactions.

- Know Your Transaction ID: Retrieve transaction details if forgotten.

- Verify Rent Receipt: Verify the authenticity of a rent receipt.

- Departmental Users: Access for departmental users through a dedicated login.

Payment Process Guidelines :

Pay Land Revenue :

- Before making a payment, ensure you have your khatiyan details ready.

- Upon proceeding, note your “Transaction Number” and “Challan Reference Number.”

- After completing the payment, record your “Bank Transaction ID or Reference Number.”

- These details are essential in case of payment failure, aiding both the user and the department.

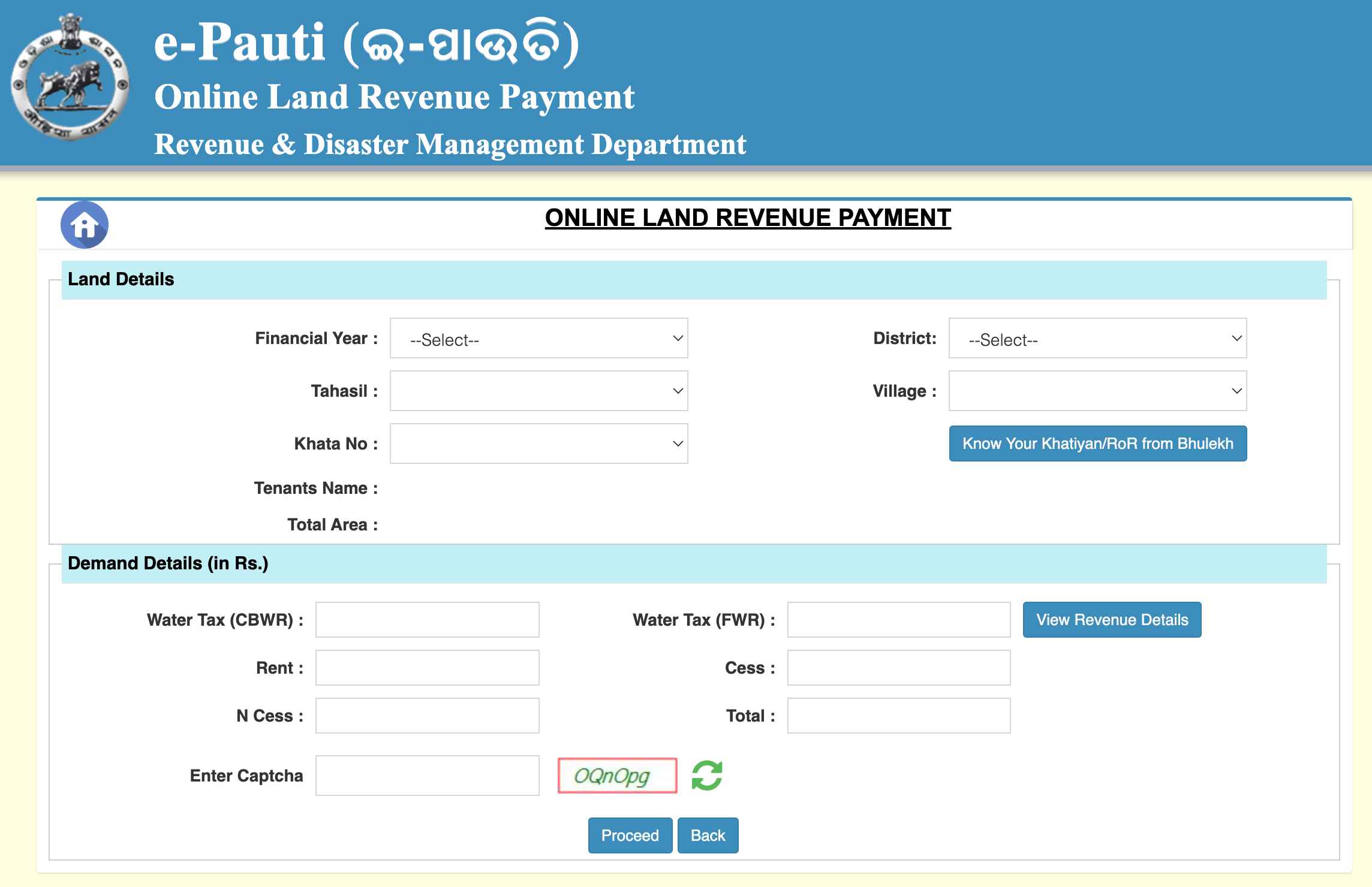

How to make ONLINE LAND REVENUE PAYMENT ?

- Visit the Official Website: Go to the Odisha Land Revenue Department’s official website – odishalandrevenue.nic.in.

- Navigate to Online Payment Section: Look for a section or link related to “Online Payment” or “e-Pauti” on the homepage or under services. This is where you initiate the process for land revenue payment.

- Select Payment Option: On the online payment page, you will typically find different payment options such as Net Banking, Debit/Credit Card (SBI ePay), or ICICI Debit Card. Choose the preferred payment method that suits you best.

- Enter Payment Details: Fill in the required details accurately. This may include your khatiyan details (land record details) and any other necessary information as prompted by the website.

- Proceed to Payment: After entering the details, click on the “Proceed” button to move to the next step in the payment process.

- Choose Bank and Complete Transaction: You will be redirected to a secure payment gateway where you need to select your bank from the available options and proceed with the payment. Follow the instructions provided on the screen.

- Note Transaction Details: During the payment process, note down important transaction details such as the Transaction Number, Challan Reference Number, and Bank Transaction ID or Reference Number. These details are essential for future reference and in case of any issues with the transaction.

- Generate Payment Acknowledgement: After successful completion of the payment, a payment acknowledgment slip or receipt will be generated on the screen. You may also have the option to download or print this acknowledgment for your records.

- Confirmation and Receipt: Verify the details on the payment acknowledgment to ensure everything is correct. The acknowledgment serves as proof of your land revenue payment.

Payment Options :

Net Banking

Debit /Credit Card (SBI ePay)

ICICI Debit Card

Payment Process Steps :

- Click “Pay Land Revenue” and enter required details along with captcha.

- Proceed to the next page after entering necessary information.

- Choose payment mode and bank name on the Treasury page, then click “Proceed.”

- Note down the Transaction Serial Number (Translno) displayed.

- Click “Proceed” on the Treasury page to confirm.

- Upon confirmation, a Treasury Challan Reference ID is generated—keep this for future reference.

- Click “Make Payment” to finalize the transaction on the respective bank’s site.

- After successful payment, a Payment Acknowledgement Slip (Screen-8) will be generated.

Other Options :

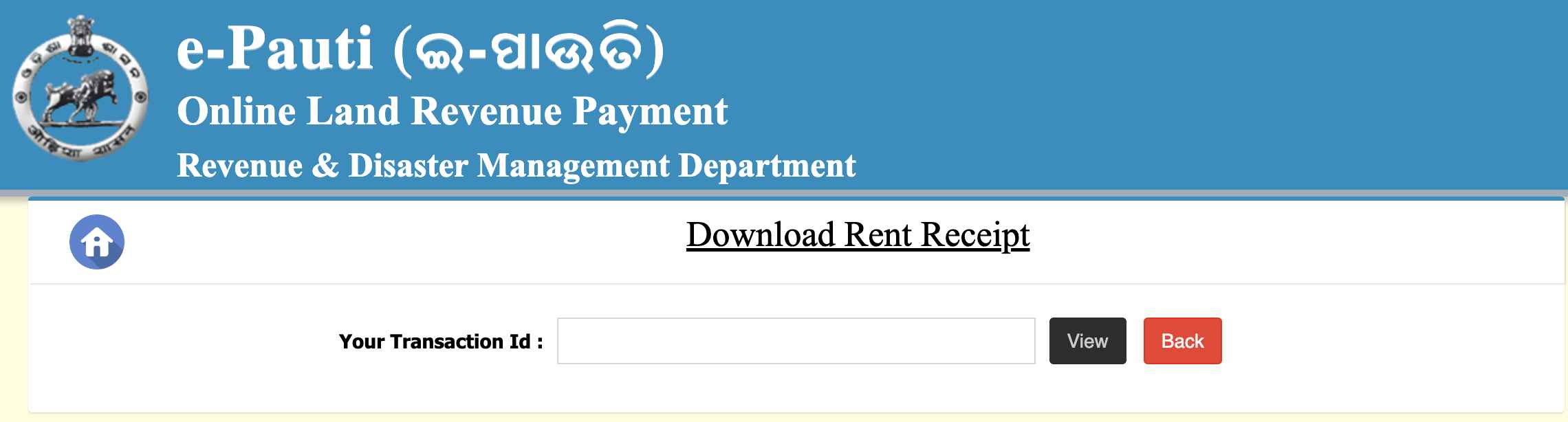

- Download Rent Receipt : Retrieve rent receipts by entering the transaction ID on the designated page.

- Know Your Transaction ID : Retrieve lost or forgotten transaction IDs by providing relevant details.

- Verify Rent Receipt : Verify the authenticity of a rent receipt by entering the transaction ID.

Download a rent receipt on Odisha Land Revenue :

To download a rent receipt on the Odisha Land Revenue Department’s website ( odishalandrevenue.nic.in ), follow these steps:

- Visit the Official Website : Go to the Odisha Land Revenue Department’s official website – odishalandrevenue.nic.in

- Navigate to Rent Receipt Section : Look for a section or link specifically labeled as “Rent Receipt” or similar. This is usually found under a menu related to services or citizen-centric services.

- Login (if required) : Some websites may require you to log in using your credentials (username and password) to access specific services like downloading rent receipts. If prompted, enter your login details correctly.

- Enter Transaction ID : Once logged in or directed to the rent receipt section, you will typically find a form where you need to enter the transaction ID associated with your rent payment. This transaction ID is usually provided to you after successful payment.

- Download Rent Receipt : After entering the correct transaction ID, submit the form or click on the download option. The website will fetch the rent receipt associated with that transaction ID.

- Save or Print : Once the rent receipt is displayed on your screen, you can download it by clicking on the download button (usually represented by a download icon) or save it directly to your device. Alternatively, you can print the rent receipt if a hard copy is required.

- Logout (if applicable) : If you logged in to access the rent receipt, remember to log out of your account to ensure security and privacy.

- Verify Details : After downloading the rent receipt, verify all the details such as the amount paid, date of payment, and other relevant information to ensure accuracy.

OFFICIAL WEBSITE >> odishalandrevenue.nic.in >> e pauti Odisha Farmer Registration Form 2025

CLICK HERE to access the official user manual (Notification) released by the government.

- e Pauti Odisha Farmer Registration Form 2025

- Online Land Revenue Payment (e-Pauti) – Objective :

- Home Page Options :

- Payment Process Guidelines :

- How to make ONLINE LAND REVENUE PAYMENT ?

- Payment Options :

- Payment Process Steps :

- Download a rent receipt on Odisha Land Revenue :

- OFFICIAL WEBSITE >> odishalandrevenue.nic.in >> e pauti Odisha Farmer Registration Form 2025

My faret Vijay anna