Apply Online for Nps Vatsalya Scheme 2024 : enps.nsdl.com . Check Eligibility, Status of Scheme, Who Can Apply, benefits.

NPS Vatsalya, introduced in Budget 2024 – Key Points :

Purpose : Allows parents to contribute to minors’ retirement funds; converts to standard NPS at adulthood

Current NPS Adoption: 10-15% in corporate sector

Key Facts about NPS :

- Voluntary : Retirement benefit scheme by the Government of India

- Eligibility : Open to all Indian citizens, including NRIs and OCIs

- Investment : Market-linked (stocks, bonds)

- Flexibility : Options for early exit or superannuation

- PRAN : Permanent Retirement Account Number for life

- Regulation : Overseen by PFRDA

Tax Benefits :

- Section 80C : Up to ₹1.5 lakh deduction

- Section 80CCD(1B) : Additional ₹50,000 deduction

- Employer Contributions : Private sector up to 10% of salary, Central Government up to 14%

- Self-Employed : 20% of gross income, plus ₹50,000 extra

Nps Vatsalya Scheme 2024

Finance Minister Nirmala Sitharaman introduced the NPS Vatsalya scheme in Budget 2024. This initiative proposes a National Pension Scheme (NPS) tailored for minors, allowing parents to contribute towards their children’s retirement fund from an early age. Upon reaching adulthood, the account seamlessly transitions into a standard NPS account.

However, with NPS adoption modest at 10-15% in the corporate sector and individuals facing challenges in allocating savings to retirement plans, expecting them to prioritize their children’s old age savings may be ambitious. Citizens need robust investment avenues for funding higher education costs.

Key Facts about NPS :

- Voluntary Retirement Scheme: NPS is a retirement benefit scheme initiated by the Government of India to ensure regular income post-retirement for all subscribers.

- Inclusive Eligibility: Citizens of India, including residents, non-residents, and Overseas Citizens of India (OCIs), can open an NPS account.

- Retirement Corpus Building: It enables individuals to accumulate a retirement corpus by making consistent contributions over their professional careers.

- Market-Linked Investments: Contributions to NPS are invested in market-linked instruments like stocks and bonds, offering potential for higher returns compared to traditional fixed-income options.

- Flexibility in Exit Options: Subscribers have the flexibility to exit the scheme before retirement or opt for superannuation based on their financial planning needs.

- Unique PRAN: Each subscriber receives a Permanent Retirement Account Number (PRAN) that remains constant irrespective of changes in employment, city, or state, accessible from anywhere in India.

- Regulatory Oversight: PFRDA (Pension Fund Regulatory and Development Authority) oversees the functioning and regulations of NPS.

- Tax Benefits: Contributions to NPS qualify for tax deductions under Section 80C, with an additional deduction of up to ₹50,000 available under Section 80CCD(1B).

NPS Vatsalya – A New Pension Scheme for Minors :

Overview of National Pension Scheme (NPS) :

- The NPS is a voluntary pension system available to Indian citizens, including residents and NRIs, aged between 18 and 70 years.

- It operates as a market-linked contribution scheme designed to help individuals save systematically for retirement.

- Tax benefits are a key feature of the NPS, accessible under various sections of the Income Tax Act.

Tax Benefits Under the NPS :

Employees who contribute to the NPS can claim tax deductions :

- Up to 10% of salary (Basic + DA) under section 80 CCD(1), within the overall limit of Rs. 1.50 lakh under Sec 80 CCE.

- An additional deduction of up to ₹50,000 under section 80 CCD(1B) beyond the Rs. 1.50 lakh limit.

Benefits of NPS Vatsalya Scheme :

Promotion of Savings Habits :

- Encourages savings habits in children from an early age.

- Upon turning 18, the account can be converted to a standard NPS scheme, allowing independent management and contributions.

Retirement Fund Option :

- Contributions begin when the child is a minor, accumulating a substantial amount by retirement.

- Allows withdrawal of 60% of accumulated amount at retirement.

- Converts to a standard NPS account at majority, ensuring continuity and potential for a robust retirement corpus.

Financial Security and Growth :

- Provides a systematic approach to securing the child’s financial future.

- Teaches responsible financial management and early investment habits.

Overall Scheme Value :

Valuable tool for building a retirement corpus and ensuring financial stability for children.

Applicability of NPS Vatsalya Scheme : Who Can Apply?

1. The NPS Vatsalya Scheme is applicable to all parents and guardians of minor children.

2. It extends the NPS coverage to include minors, offering a new investment avenue for ensuring children’s financial security and retirement planning.

NPS Vatsalya Scheme Application Process :

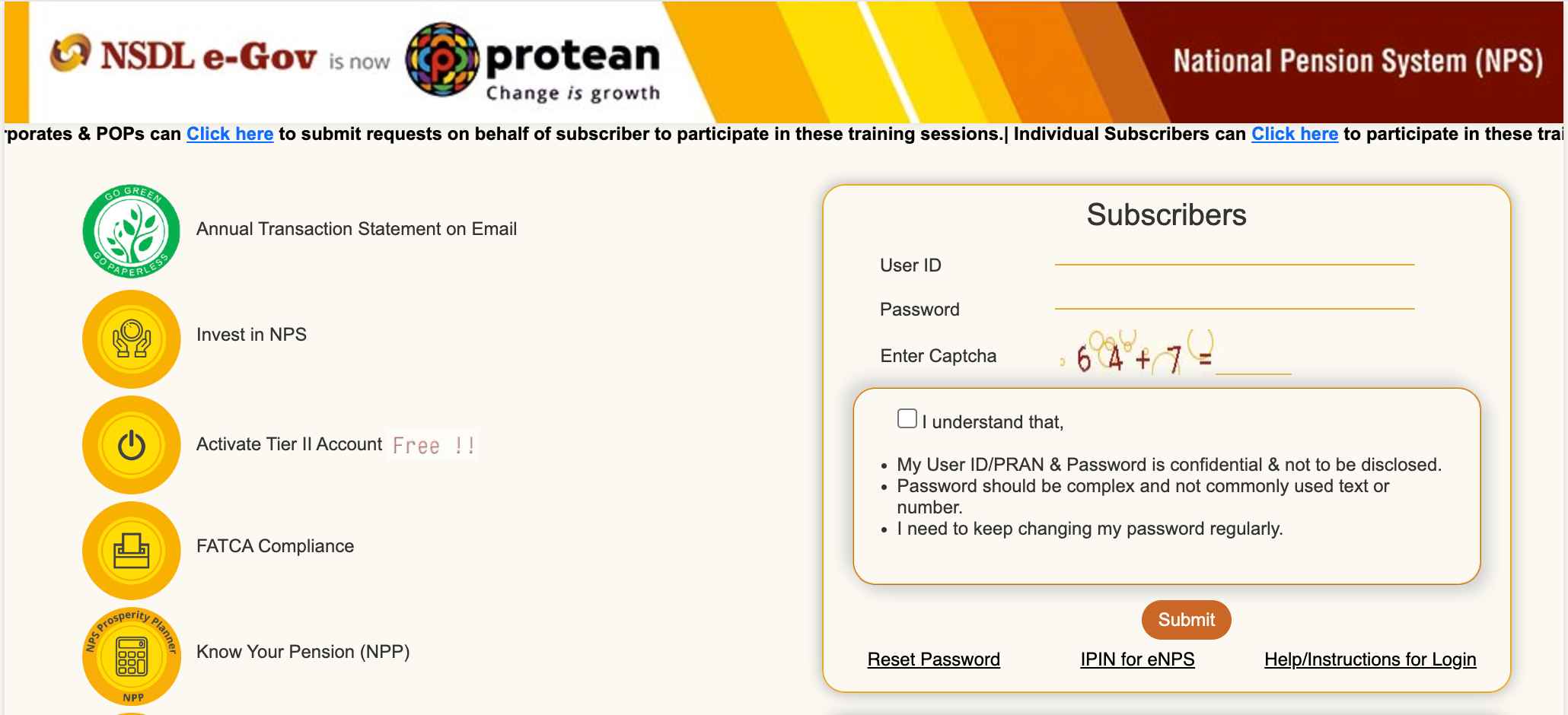

- Visit the Official Website : Navigate to the official NPS website. The homepage of the website will appear.

- Click on “Apply Here” : Select the “apply here” option displayed on the homepage. You will be redirected to a new page containing the application form.

- Provide Your Information : Enter your personal details such as name, address, age, and date of birth. Upload all the required documents.

- Review Your Information : Carefully review all the information filled in the application form.

- Submit Your Application : Click on the submit button to successfully apply for the NPS Vatsalya Scheme.

How to Open / Apply for NPS Vatsalya Scheme ?

Opening Process :

- The Central Government is expected to release details soon on how to open or apply for the NPS Vatsalya Scheme.

- Applicants may likely be able to apply through the official eNPS website provided by the Central Government.

- Alternatively, opening and contributing to the NPS Vatsalya Scheme might also be facilitated through selected banks’ internet banking portals.

Eligibility for NPS Vatsalya :

All parents and guardians, including Indian citizens, NRIs, or OCIs, are eligible to open an NPS Vatsalya account for their minor children.

Employer Contribution Benefits :

- Employers contributing to employees’ NPS accounts can claim a tax deduction.

- The deduction is up to 10% of salary (Basic + DA) for contributions by private sector employers.

- Contributions made by the Central Government enjoy an increased deduction of up to 14% of salary under Section 80 CCD(2).

- This deduction is over and above the Rs. 1.50 lakh limit specified in section 80 CCE.

Self-Employed Individuals :

- Self-employed individuals can also avail tax benefits through the NPS.

- They can claim a deduction of up to 20% of their gross income under section 80 CCD(1).

- This deduction falls within the overall limit of Rs. 1.50 lakh under Sec 80 CCE.

- An additional deduction of up to ₹50,000 is available under section 80 CCD(1B).

Changes to NPS Contribution Limits :

OFFICIAL WEBSITE >> enps.nsdl.com >> NPS Vatsalya Scheme

- NPS Vatsalya, introduced in Budget 2024 – Key Points :

- Nps Vatsalya Scheme 2024

- Key Facts about NPS :

- NPS Vatsalya – A New Pension Scheme for Minors :

- Benefits of NPS Vatsalya Scheme :

- Financial Security and Growth :

- Overall Scheme Value :

- Applicability of NPS Vatsalya Scheme : Who Can Apply?

- NPS Vatsalya Scheme Application Process :

- How to Open / Apply for NPS Vatsalya Scheme ?

- Eligibility for NPS Vatsalya :

- Impact on Taxpayers :

- Required Documents :

- Tax Benefits with NPS :

- Employer Contribution Benefits :

- Self-Employed Individuals :

- Changes to NPS Contribution Limits :

- OFFICIAL WEBSITE >> enps.nsdl.com >> NPS Vatsalya Scheme