kviconline.gov.in Pmegp Eportal Kvic : Pmegp Loan Apply Online login, helpline Number, Age Limit, Project List

Important Points for KVIC PMEGP E-Portal :

- The KVIC PMEGP E-Portal is designed for applying for PMEGP loans online.

- The official website can be found at kviconline.gov.in.

- Key features include:

- Online loan applications for new manufacturing and service projects.

- An online login to track the status of applications.

- Access to lists of projects and relevant guidelines.

- The minimum age to apply is 18 years.

- Loan amounts available are up to ₹50 lakh for manufacturing projects and ₹20 lakh for services.

- A helpline number for assistance is provided on the portal.

kviconline.gov.in Pmegp Eportal

The Prime Minister’s Employment Generation Programme (PMEGP) aims to generate job opportunities in rural and urban areas by helping to set up new self-employment projects or micro-enterprises. Beneficiaries receive a subsidy of 15% to 35% of the project cost, based on their category and location.

Beneficiary must contribute 5-10% of the total project expense. Bank Financing : banks cover the remaining project costs. Expansion Loans, a second loan is available for those looking to expand or upgrade successful PMEGP or MUDRA projects.

Features of PMEGP Scheme :

Repayment Tenure :

- Ranges from 3 to 7 years.

- Includes a moratorium period set by the financing bank or institution.

Project Cost :

- For New Enterprises:

- Manufacturing Sector: Maximum project cost for Margin Money subsidy is Rs 50 lakhs.

- Business/Service Sector: Maximum project cost for Margin Money subsidy is Rs 20 lakhs.

- For Existing PMEGP/REGP/MUDRA Units (Second Loan for Upgradation):

- Manufacturing Sector: Maximum project cost for Margin Money subsidy is Rs 1 crore.

- Business/Service Sector: Maximum project cost for Margin Money subsidy is Rs 25 lakhs.

Capital and Working Capital Expenditure :

- Capital expenditure, including construction, should not exceed 60% of the total project cost.

- Working capital should not exceed 40% of the total project cost.

- Banks may set loan criteria based on the project’s nature during approval.

PMEGP Scheme Highlights :

| Article Name | PMEGP Scheme |

| Repayment Tenure | 3 to 7 years |

| Age Requirement | Applicants must be over 18 years old |

| Maximum Project Cost – First PMEGP Loan | Rs 50 lakhs for Manufacturing Units |

| Rs 20 lakhs for Service Units | |

| Maximum Project Cost – Second PMEGP Loan | Rs 1 crore for Manufacturing Units |

| Rs 25 lakhs for Service Units | |

| Subsidy on Projects | Between 15% and 35% |

| Lock-in Period for Government Subsidy | 3 years after successful verification |

| Educational Qualification | At least an 8th class pass is needed for projects over Rs 10 lakh in manufacturing or over Rs 5 lakh in services / business |

| Official Website | kviconline.gov.in |

What is the PMEGP Scheme ?

The Prime Minister’s Employment Generation Programme (PMEGP) is a government initiative run by the Union Ministry of Micro, Small and Medium Enterprises (MoMSME). Its goal is to promote self-employment in both rural and urban areas by offering credit-linked subsidies to new self-employment projects and micro-enterprises.

Subsidy Details :

Implementation :

The scheme is carried out by the Khadi and Village Industries Commission (KVIC) at the national level, with support from State Khadi and Village Industries Boards (KVIBs), State offices of KVIC, Coir Board (for coir activities), District Industries Centres (DICs), and state-level banks.

Subsidy Disbursement :

The margin money subsidy is sent from KVIC to the branches of financing banks through a nodal bank. After the lock-in period, the financing bank credits the subsidy to the borrower’s account based on the verification report.

Collateral :

- Projects costing up to Rs 10 lakhs do not require collateral under PMEGP loans.

Margin Money Subsidy :

- Offered as one-time assistance and is not available for credit limit increases, modernization, or expansion, except for upgradation through a second loan.

- PMEGP units must register on the Udyam Portal before adjusting margin money.

- Projects financed by two different banks or financial institutions are ineligible for margin money assistance.

Rate of Subsidy for Setting Up New Enterprises :

- Urban Area :

- General Category: 15%

- Special Categories (e.g., ST/SC/OBC, Minorities, Ex-servicemen, Physically Handicapped, Women/Transgender, NER, Hill and Border areas): 25%

- Rural Area :

- General Category: 25%

- Special Categories: 35%

Rate of Subsidy for Existing PMEGP/REGP/MUDRA Units (Second Loan for Upgradation) :

- All Categories : 15%

- NER and Hill States : 20%

EDP Training Overview :

Mandatory training requirements:

- Projects exceeding Rs 5 Lakhs: Requires 10 working days of EDP training.

- Projects up to Rs 5 Lakhs: Requires 5 working days of EDP training.

- Projects up to Rs 2 Lakhs: EDP training is not necessary.

Training Information :

- The program includes sessions with successful entrepreneurs, interactions with banks, and field visits.

- KVIC provides a free 2-day online EDP training module for aspiring entrepreneurs.

- Applicants with at least 60 hours of online training or 10 days of offline training in EDP, ESDP, SDP, or VT are exempt from further EDP training.

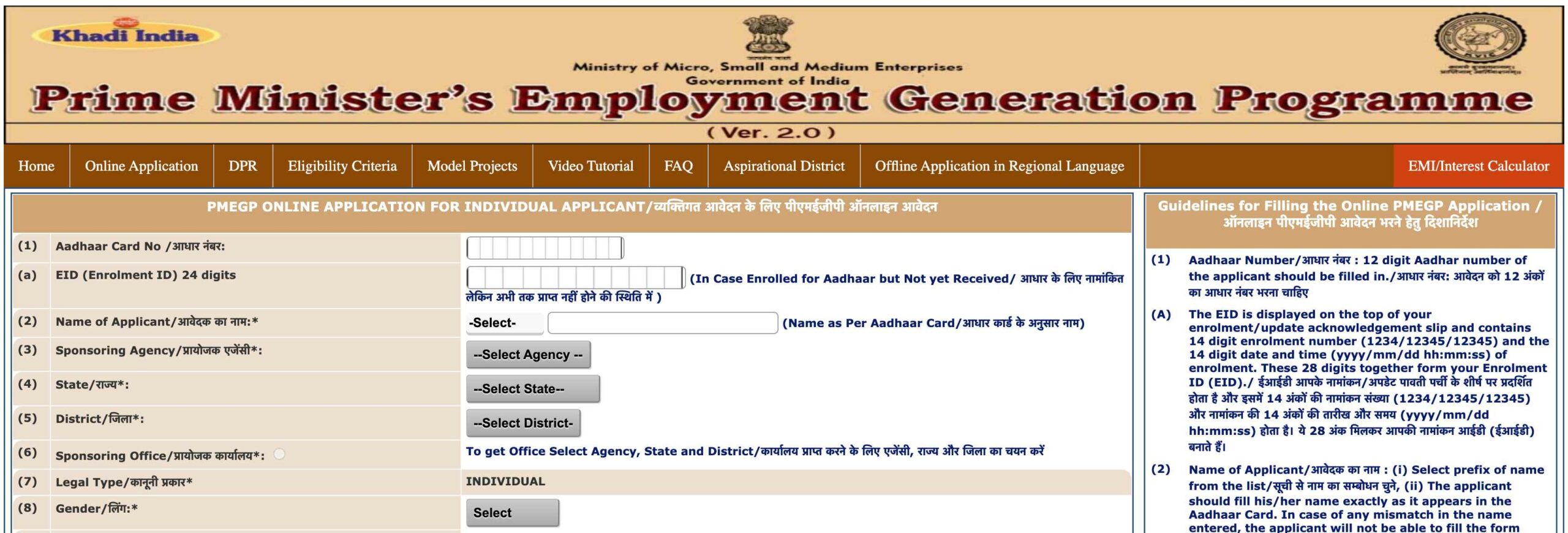

Steps to Apply for PMEGP Loan Online :

- Visit the PMEGP portal.

- Fill out and save the PMEGP loan application form online. A username and password will be sent to your registered mobile number for status tracking.

- Upload the following documents along with a photo:

- Caste Certificate

- Special Category Certificate (if applicable)

- Project Report

- Rural Area Certificate

- Education/EDP/Skill Development Training Certificate

- Any other relevant documents

- Submit the application form. A unique Application ID will be generated and sent to your registered email address. The application and documents will be electronically sent to the chosen Implementation Agency (IA).

After Submission :

- Within 5 working days, a nodal officer from KVIC, State KVIB, DIC, or other IAs will reach out for a preliminary review.

- The applicant must present their own contribution and submit a copy of the EDP training certificate, a photo, and Aadhaar number to the Financing Bank within 30 working days of loan approval notification.

- The training institute will upload the EDP certificate.

PMEGP Loan Eligibility Criteria :

For New Enterprises (Units) :

- Minimum Age : Above 18 years.

- Income Criteria : No income restrictions.

- Educational Qualification :

- Minimum VIII standard for projects over Rs 10 lakh (manufacturing).

- Minimum VIII standard for projects over Rs 5 lakh (service /business).

Eligible Projects :

- New microenterprises, including village industries, except those prohibited by local authorities or listed in the negative list.

Ineligible Projects :

- Existing units or those that have received any government subsidy (e.g., PMRY, REGP, CMEGP).

- Projects lacking capital expenditure (Term Loan).

Cost Considerations :

- Land costs are not part of the project expenses.

- Costs for pre-built sheds and long-term leases or rentals for a workshed (up to 3 years) can be included.

Implementing Agencies :

- KVIB, DIC, KVIC, and Coir Board can process applications in both rural and urban settings.

Documents needed for the PMEGP loan include :

For new enterprises :

- Passport size photo

- Project report (summary or detailed)

- Certificate of highest educational qualification

- Rural area certificate (if applicable)

- Social or special category certificate (if applicable)

For existing PMEGP /REGP /MUDRA units (second loan for upgrading) :

- Previous loan sanction letter from the bank

- Proof of margin claims adjusted against the previous loan

- Bank certificate confirming full loan repayment

- Project report for unit expansion or upgrading

- Passport size photograph

- Last three years of IT returns

- Last three years of annual accounts, certified by a Chartered Accountant

Documentation Requirements :

- A valid Aadhaar Number is necessary.

- Consent for demographic details authentication from UIDAI is required.

- Only one person per family (including self and spouse) can apply for the PMEGP loan.

For Upgrading Existing PMEGP /REGP /MUDRA Units :

- Margin Money: Subsidy needs to be adjusted after a 3-year lock-in period.

- Repayment: The initial loan must be fully repaid.

- Application: Can apply for a second loan from the same or a different bank. The unit must demonstrate profitability over the past 3 years and show growth potential through modernization.

- Registration: UdyogAadhaar Memorandum (UAM) registration is required.

- Employment: The second loan must lead to additional job creation.

Negative List Activities Not Allowed – Prohibited Activities :

- Meat processing, canning, or serving (excluding non-vegetarian food in hotels/dhabas).

- Manufacturing polythene carry bags thinner than 75 microns or recycled plastic carry bags.

- Cultivating certain crops or plantations (e.g., tea, coffee, rubber), horticulture, floriculture, and certain animal husbandry practices (value addition is permitted).

Allowed Activities in Animal Husbandry :

- Dairy : Production of milk and dairy products from various animals like cows, goats, and buffaloes.

- Poultry : eggs and meat production from poultry such as chickens and ducks.

- Aquaculture : farming of aquatic organisms like fish and mollusks.

- Insect farming includes beekeeping.

OFFICIAL WEBSITE << kviconline.gov.in >> PMEGP Scheme

CLICK HERE to apply online for the PMEGP scheme.

- Important Points for KVIC PMEGP E-Portal :

- kviconline.gov.in Pmegp Eportal

- Features of PMEGP Scheme :

- Repayment Tenure :

- Project Cost :

- Capital and Working Capital Expenditure :

- PMEGP Scheme Highlights :

- What is the PMEGP Scheme ?

- Subsidy Details :

- Implementation :

- Subsidy Disbursement :

- Collateral :

- Margin Money Subsidy :

- Rate of Subsidy for Setting Up New Enterprises :

- Rate of Subsidy for Existing PMEGP/REGP/MUDRA Units (Second Loan for Upgradation) :

- EDP Training Overview :

- Steps to Apply for PMEGP Loan Online :

- After Submission :

- PMEGP Loan Eligibility Criteria :

- For New Enterprises (Units) :

- Eligible Projects :

- Ineligible Projects :

- Cost Considerations :

- Implementing Agencies :

- Documents needed for the PMEGP loan include :

- For new enterprises :

- For existing PMEGP /REGP /MUDRA units (second loan for upgrading) :

- Documentation Requirements :

- For Upgrading Existing PMEGP /REGP /MUDRA Units :

- Negative List Activities Not Allowed – Prohibited Activities :

- Allowed Activities in Animal Husbandry :

- OFFICIAL WEBSITE << kviconline.gov.in >> PMEGP Scheme

is briquettes and charcoal manufacturing under this scheme?

we have a registered llp but have not started any manufacturing due to lack of tech support.