www.tin-nsdl.com itr Refund Status 2024 Check by Pan Card, itr intimation password. Check after itr intimation how many days to refund.

www.tin-nsdl.com itr Refund Status 2024 Check by Pan Card, itr intimation password

If you have paid more taxes than your actual liability, you can request a refund for the excess amount. The Income Tax Department offers an online facility for tracking your income tax refund status, allowing you to easily check the progress of your refund by entering your PAN (Permanent Account Number) and the applicable Assessment Year. Tax refunds are initiated by the department once you have E-verified your return, typically taking 4-5 weeks to deposited in your bank account.

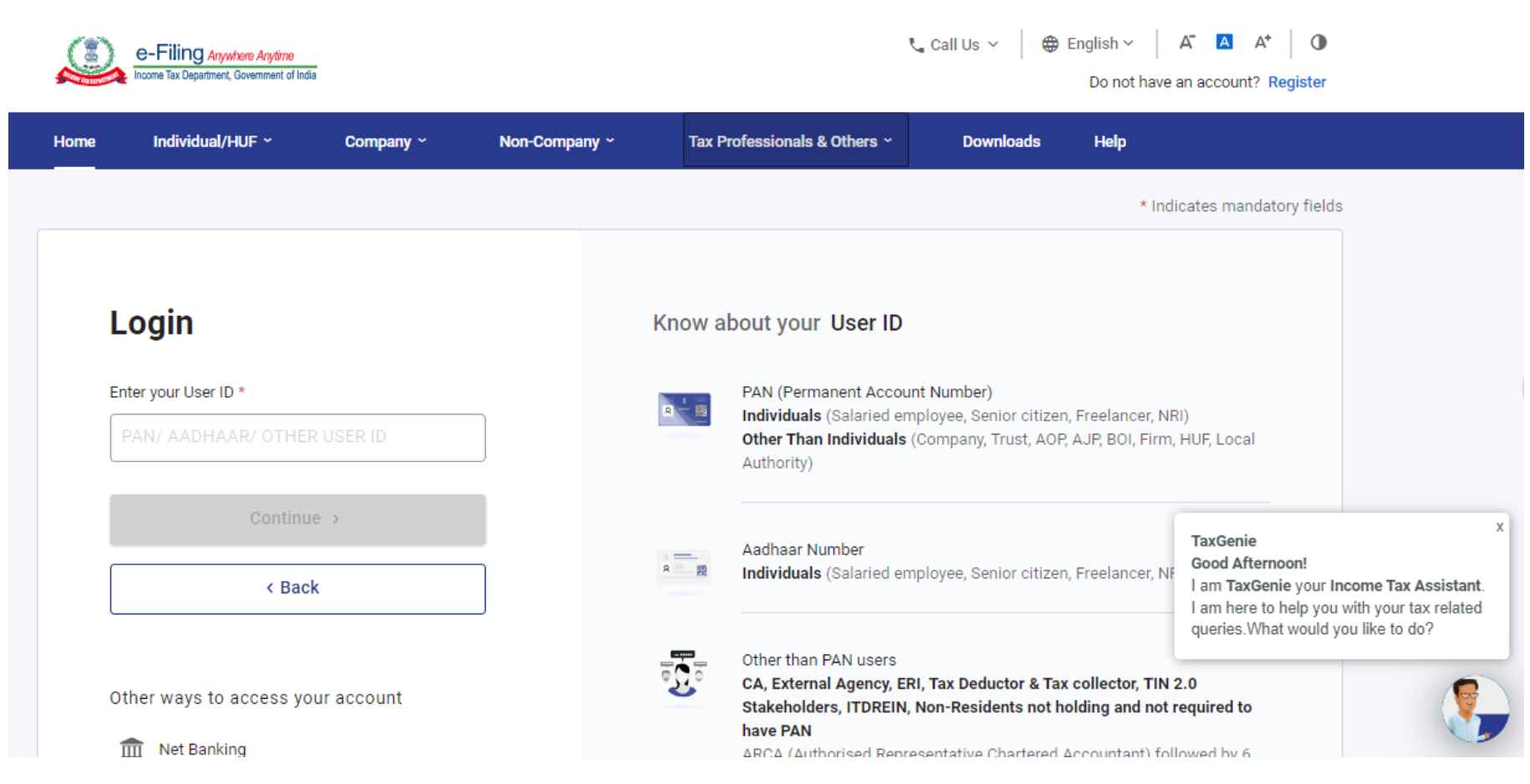

If the refund is not received within this timeframe, you should take certain steps: check for any discrepancies or errors in your ITR by logging into the e-filing portal and viewing filed returns, review your email for notifications from the Income Tax Department regarding the status of the refund, and check the refund status using the methods provided by the department.

Is the Income Tax Refund Taxable ?

- No, the refund amount itself is not taxable.

- However, the interest received on the tax refund is taxable at your applicable tax slab rate.

Time Duration for a Tax Refund :

- The time to receive the tax refund depends on the Income Tax Department’s internal process.

- Typically, it takes 7 to 120 days, with an average of 90 days after e-verifying your return.

- The new refund processing system aims to reduce processing time to a few days.

- Average processing duration has reduced to:

- 10 days for AY 2023-24

- 82 days for AY 2019-20

- 16 days for AY 2022-23

Mode of Receiving the Refund :

- Refunds are sent via electronic mode (direct credit) or ‘Refund Cheque’.

- Ensure correct bank account number, IFSC code, and address details (including PIN code) in your return.

- Cheques are dispatched to the address mentioned in the ITR via speed post.

Interest on Income Tax Refund :

- If the refund amount exceeds 10% of the total tax payable, you receive simple interest on the refund.

- Interest is calculated at 6% per annum on the refund amount.

- Interest is computed from the beginning of the next financial year until the refund date.

Claiming Refund for Missed ITR Filing on Due Date :

- The deadline for filing ITR for non-audit cases was 31st July 2024.

- If you missed the deadline, you can still file a Belated Return by 31st December 2024.

- You can claim your tax refund through a belated return.

Income Tax Refund – How to Check Status for FY 2023-24 (AY 2024-25) ?

What Does My Refund Status Mean ?

-

No E-filing for Current AY :

- What does this mean? Your IT return might not have filed.

- What to do now? Double-check the Assessment Year for your refund status (e.g., FY 2022-23 corresponds to AY 2023-24).

-

Under Processing :

- What does this mean? The income tax department has not yet processed your return.

- What to do now? Check your refund status after a month for updates.

-

Refund Issued :

- What does this mean? The refund has sent (by cheque or direct debit to your bank account).

-

Processed with No Demand No Refund :

- What does this mean ?

- You filed with no refund or tax due.

- The income tax department denied your refund due to calculation mismatches.

- What to do now?

- Revise your return if deductions missed.

- Fix errors and file a rectification based on the intimation u/s 143(1).

- What does this mean ?

-

Refund Failure :

- What does this mean? Incorrect bank details submitted, preventing the refund.

- What to do now?

- Log in to incometax.gov.in, correct and validate bank details.

- Apply for ‘Refund Reissue’ from your e-filing account.

-

Case Transferred to Assessing Officer :

- What does this mean?

- Further clarification /information needed.

- Possible outstanding taxes to adjusted against the refund.

- What to do now? Contact the AO (Jurisdictional Assessing Officer) for your region.

- What does this mean?

-

Demand Determined :

- What does this mean? Refund request rejected; unpaid taxes owed.

- What to do now?

- Read the intimation carefully and verify your information.

- Pay the demanded tax if your refund request was erroneous.

- File a rectification if the IT department made a mistake.

-

Check Rectification Processed – Refund Determined :

- What does this mean? Rectified returns accepted, refund calculated and credited.

- Follow-up: Receive revised intimation and refund amount.

-

Rectification Processed – Demand Determined :

- What does this mean? Rectified returns accepted, but unpaid taxes still owed.

- What to do now? Pay the outstanding amount within 30 days of receipt of intimation.

-

Rectification Processed – No Demand No Refund :

- What does this mean? Rectified returns accepted; no extra taxes owed, no refund due.

- Follow-up: Receive a revised intimation clarifying this.

OFFICIAL WEBSITE >> Refund Status 2024 Check by Pan Card >> tin-nsdl.com

tin-nsdl.com Redirect to : www.protean-tinpan.com

Income Tax Portal Check here

- www.tin-nsdl.com itr Refund Status 2024 Check by Pan Card, itr intimation password

- Is the Income Tax Refund Taxable ?

- Time Duration for a Tax Refund :

- Mode of Receiving the Refund :

- Interest on Income Tax Refund :

- Claiming Refund for Missed ITR Filing on Due Date :

- Income Tax Refund Status :

- Income Tax Refund – How to Check Status for FY 2023-24 (AY 2024-25) ?

- Claiming an Income Tax Refund :

- Steps to Take if Refund is Delayed :

- How to Claim an Income Tax Refund ?

- Checking Your ITR Refund Status for AY 2024-25 :

- Through the Income Tax Portal :

- Through NSDL Portal :

- Through TRACES :

- What Does My Refund Status Mean ?

- No E-filing for Current AY :

- Under Processing :

- Refund Issued :

- Processed with No Demand No Refund :

- Refund Failure :

- Case Transferred to Assessing Officer :

- Demand Determined :

- Check Rectification Processed – Refund Determined :

- Rectification Processed – Demand Determined :

- Rectification Processed – No Demand No Refund :

- OFFICIAL WEBSITE >> Refund Status 2024 Check by Pan Card >> tin-nsdl.com