igrdhc.maharashtra.gov.in Check DHC IGR Grass Challan Maharashtra : Gras Mahakosh, Digital 7/12

DHC IGR Grass Challan Maharashtra : Key Points

DHC IGR Grass Challan Maharashtra : Gras Mahakosh, Digital 7/12

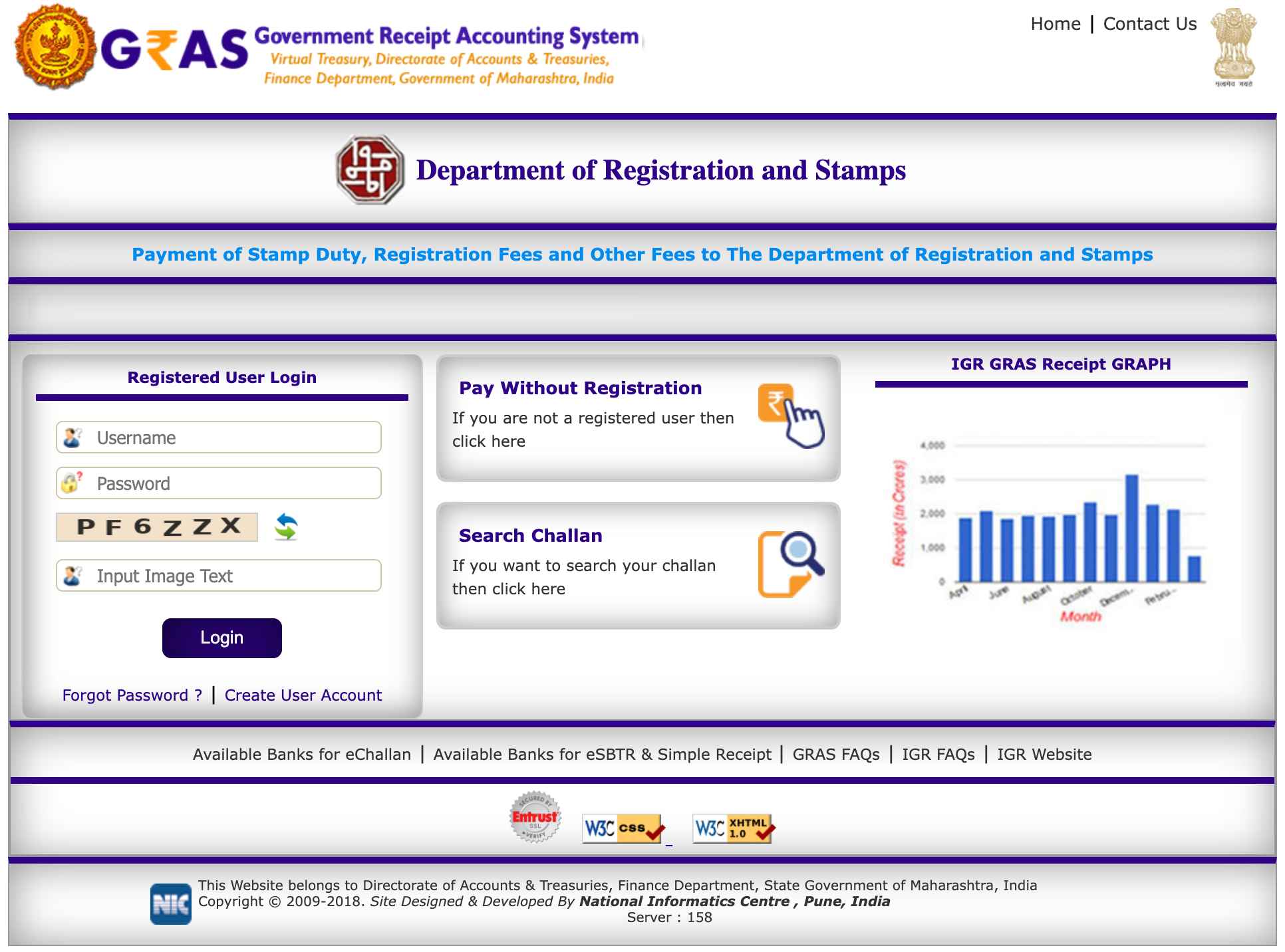

The Maharashtra government launched a ground-breaking program called the Government Receipt Accounting System (GRAS) with the goal of digitizing financial transactions. GRAS, which is run by the Finance Department, simplifies the procedure for both people and companies by allowing taxpayers to quickly make online payments using approved bank portals.

With its round-the-clock availability, the system boosts consumer confidence and streamlines the payment process by offering instantaneous online receipts and a unique transaction number upon payment. Some bank counters offer payment options for people without internet access. GRAS encourages efficiency, accountability, and openness within the state’s financial ecosystem by updating the payment architecture.

In addition, after you’ve paid the required stamp duty and registration fees, the Inspector General of Registration (IGR) Maharashtra is essential in helping you register your sale deed with the Department of Registration and Stamps if you’re purchasing real estate in Maharashtra. Please visit the official GRAS website for further information.

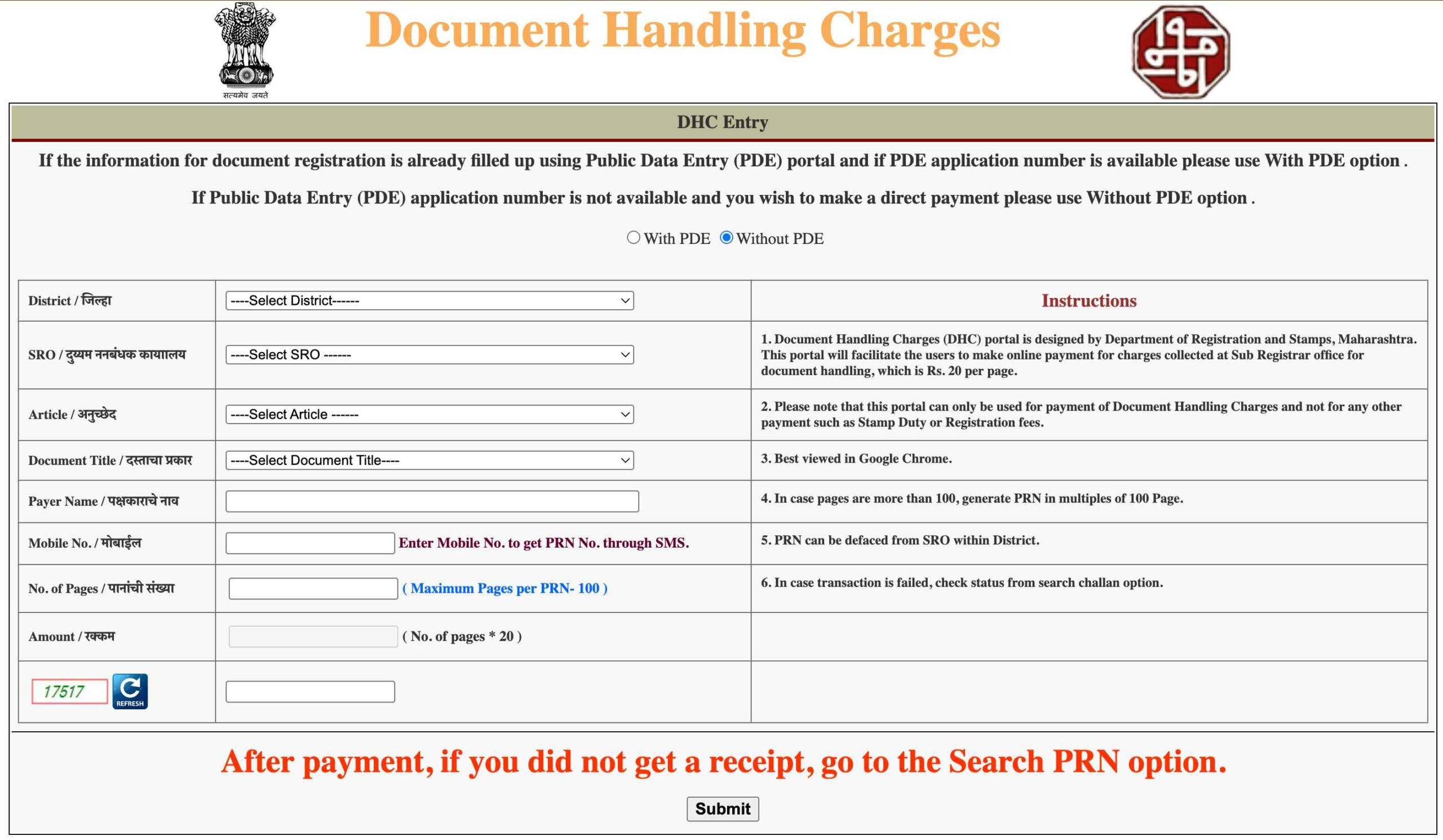

DHC : Document Handling Charges

DHC IGR Grass Challan Maharashtra :

| Feature | Details |

|---|---|

| Initiative | Government Receipt Accounting System (GRAS) |

| State | Maharashtra |

| Managed By | Finance Department |

| Purpose | Digitizing financial transactions |

| Accessibility | Online payments via authorized bank portals |

| Operating Hours | 24/7 |

| Receipt Generation | Instant online receipts with unique transaction numbers |

| Alternative Payment | Available at select bank counters for those without internet |

| Key Role of IGR | Registers sale deeds and processes stamp duty payments |

| Official Website | igrdhc.maharashtra.gov.in |

How to Search and Verify Challan (Unregistered Users) ?

- Access the GRAS portal and click on “Search Challan.”

- Fill in the necessary information by selecting the department, district or treasury, bank, and the challan amount.

- Choose your search criteria: either enter the Government Reference Number (GRN) or the Challan Identification Number (CIN) from your bank transaction.

- Click the “Search” button to find your challan details.

- If the GRAS site has received the bank’s CIN, you will see the challan details, including the amount and payment status.

- Check whether the payment status is marked as “Verified.” If it is unverified, the bank’s CIN might not be updated.

- If needed, click on the “Verify” link to update the bank’s CIN on the GRAS site.

How to Pay Tax Without Registration (e-Payment) ?

- Access the GRAS Portal : Open your web browser and navigate to the Government Receipt Accounting System (GRAS) portal of Maharashtra.

- Select “Pay Without Registration” : Click on the “Pay Without Registration” option on the homepage to start the payment process.

- Choose Payment Mode : On the payment screen, select “e-payment” for online transactions.

- Provide Challan Details: Fill in the required information by selecting the department, payment type, scheme name, relevant district, office name, and payment period (default is the current financial year).

- Enter Tax Amount : Input the tax amount for each tax type listed.

- Provide Personal Details : On the right side, enter your personal information, including Tax ID (if relevant), PAN (if required), full name, contact address (with PIN code), mobile number, and any additional remarks.

- Choose Bank and Submit Challan : Select your bank from the dropdown list and click the “Submit” button.

- Proceed to Payment : After submission, you will be directed to your bank’s payment portal.

- Complete Payment : Enter your Internet Banking details on the bank’s portal to finish the payment.

- Receive Confirmation : After payment, note the confirmation details: bank’s Challan Identification Number (CIN), branch code, and Payment Reference Number (PRN).

How to Search and Verify Challan for Unregistered Users ?

- Go to the GRAS portal and click on “Search Challan.”

- Enter the necessary information: choose the department, district or treasury, bank, and challan amount.

- Choose Search Criteria

Select one of the following :- GRN No: Provide the Government Reference Number.

- Bank CIN: Enter the Challan Identification Number from your bank transaction.

- Click the “Search” button to get your challan details.

- If the GRAS site has received the bank’s CIN, you will see the challan details, including the amount and payment status.

- Check if the payment status shows “Verified.” If it is unverified, this indicates the bank’s CIN has not been updated.

- If needed, click on the “Verify” link to update the bank’s CIN on the GRAS site.

- After updating, repeat the search to check the updated challan details.

- If the challan is verified, click on the GRN No. to see the detailed challan.

- If desired, you can print the challan for your records.

How to Search and Verify Challan for Registered Users ?

- Use your registered username and password to log in.

- Once logged in, you will arrive at the home screen.

- Click “Click here to see last 10 transactions” to check your recent transactions.

- Hover over the GRN (Government Reference Number) to see its explanatory message.

- Choose the relevant GRN to access the associated challan.

- If the payment is verified, clicking the GRN will show the challan. If it is unverified, click “Verify” to update the bank CIN.

- Clicking on the GRN will display either the challan or a response screen.

- Close the response screen and go back to the home page.

DHC IGR Grass Challan Maharashtra : Departments

| Department Name | Department | Department |

|---|---|---|

| Directorate of Anti Corruption Bureau, M. S. Mumbai | Co-operation, Marketing and Textiles Department (Mantralaya) | Directorate of Medical Education and Research |

| Commissionerate of Agriculture | Minority Development Department Mantralaya | Directorate of Insurance |

| Commissionerate of Animal Husbandry | Finance Department (Mantralaya) | Directorate of Marketing |

| Principal Judge, Bombay City Civil and Sessions Court | General Administration Department (Mantralaya) | Directorate of Tourism |

| Directorate of Steam Boilers | Home Department (Mantralaya) | District and Sessions Court |

| Mantralaya Square Meal and Canteen | Maharashtra Institute of Labour Studies | Directorate of Social Forestry |

| Principal Chief Conservator of Forests | P. L. Deshpande Maharashtra Kala Academy | Directorate of Technical Education |

| Commissioner for Cooperation and Registrar of Cooperative Societies | Public Works Department (Mantralaya) | Directorate of Town Planning and Valuation |

| Commissioner Disability Welfare | Rural Development and Panchayat Raj Department Mantralaya | Commissioner, State Excise |

| Chief Electrical Inspector | Public Prosecutor for Greater Mumbai | Food and Drugs Administration |

| Controller of Legal Metrology | P W D Field Establishment | Food, Civil Supplies and Consumer Protection Department |

| Chief Metropolitan Magistrate, Bombay | Revenue Department | Registrar of Firms |

| State Commission and District Consumer Redressal Forum | Transport Commissioner | Commissionerate of Fisheries |

| Commissioner of Police, Mumbai | Special Court (TORTS), Bombay | Governor’s Secretariat |

| Commissioner of Sugar, Pune | Chief Judge, Small Causes Court, Bombay | High Court |

| Commissioner of Textiles | State Election Commission | Housing Department Field Establishment |

| Directorate of Accounts and Treasuries | Directorate of Sericulture | Inspector General of Registration |

| Directorate of Civil Defence | Commissionerate of Sales Tax | Industrial Courts |

| Commissionerate Dairy Development | State Transport Appeal Tribunal, M. S. Mumbai | Director, Forensic Laboratory and Chemical Analyzer to Government |

| Directorate of Education | Administrator General and Official Trustee, Mumbai | Directorate of Libraries |

| Directorate of Economics and Statistics | Settlement Commissioner and Director of Land Records | Motor Accidents Claims Tribunal Mumbai |

| Deputy Director Finance and Account State Lotteries | Directorate of Municipal Administration | Maharashtra Administrative Tribunal |

| Directorate of Geology and Mining | Directorate of Education Higher Education | Directorate of Industrial Safety and Health |

| Director General of Police | Directorate of Health Services | Directorate of Information Technology |

How to Pay Tax as a Registered User (e-Payment) ?

- Open your web browser and go to the GRAS portal. Sign in with your registered username and password.

- Click the “Make Payment” tab to initiate a new payment transaction.

- Choose the payment period (e.g., Annual, Half Yearly, or Quarterly). Enter details such as the payment amount, department, tax ID, and office location.

- After completing the necessary fields, click the “Submit” button.

- Check the payment information on the confirmation page. If all is correct, click “Proceed” to continue.

- You will be taken to the bank’s payment gateway. Log in with your internet banking credentials.

- Fill in the required information requested by the bank. Confirm the payment within the secure banking interface.

- After confirmation, you will return to the GRAS portal. A message will confirm the successful transaction.

- You can view and print the challan, which includes the Government Reference Number (GRN) for your records.

- Log out of your GRAS account for security after completing your payment.

Check How to Pay Tax as a Registered User (Across Bank Counter Payment) ?

- Go to the GRAS website and log in using your registered username and password.

- Click on the “Make Payment” tab in your user dashboard.

- Choose “Payment Across Bank Counter (Cash/Cheque)” from the available options.

- Choose the payment period (e.g., annual, half-yearly, or quarterly).

- Enter the tax amount for each category and fill in all necessary fields.

- Select the bank where you will make your payment.

- Click “Submit” to generate the challan.

- Review the challan details to ensure accuracy.

- Click “Proceed” to continue the payment process.

- The system will create a Government Reference Number (GRN) for your transaction.

- Write down the 18-digit GRN for future reference regarding your payment.

- Print the generated challan for submission at the bank.

- Go to the designated bank branch and submit the challan along with your cash or cheque.

- After submitting the payment, keep the acknowledgment receipt from the bank.

- Save a copy of the challan as proof of payment.

- Log out of your GRAS user account for security after finishing the process.

How to Search Challan ?

- After making any updates, repeat the search to see the latest challan details.

- If your payment is verified, click on the GRN to view the full challan details.

- You have the option to print the challan for your records.

- To search your challan history, select the “Challan History” tab.

- Specify your search criteria by selecting a date range, pay type, tax ID, and the status of the challan. Fill in the amount range.

- Click on the GRN to view the corresponding challan reference.

OFFICIAL WEBSITE << igrdhc.maharashtra.gov.in >> DHC IGR Grass Challan Maharashtra

CLICK HERE to make DHC IGR Grass Challan Payment.

- DHC IGR Grass Challan Maharashtra : Gras Mahakosh, Digital 7/12

- DHC IGR Grass Challan Maharashtra :

- How to Search and Verify Challan (Unregistered Users) ?

- How to Pay Tax Without Registration (e-Payment) ?

- How to Search and Verify Challan for Unregistered Users ?

- How to Search and Verify Challan for Registered Users ?

- DHC IGR Grass Challan Maharashtra : Departments

- How to Pay Tax as a Registered User (e-Payment) ?

- Check How to Pay Tax as a Registered User (Across Bank Counter Payment) ?

- How to Search Challan ?

- OFFICIAL WEBSITE << igrdhc.maharashtra.gov.in >> DHC IGR Grass Challan Maharashtra