Official Notification 2025 : Whatsapp Channel

Join Now

Check Employment Linked Incentive Scheme List 2024 : Apply Online

Employment linked incentive Scheme

Key Features :

- Sector Inclusivity : Applicable across all sectors for newly joined employees.

- Income Criteria : Eligible for individuals earning less than Rs.1 lakh per month.

- Beneficiary Count : Expected to benefit approximately 210 lakh youth over 2 years.

- Skill Development : Aims to support the learning curve of first-time employees.

- Employer Incentive : Encourages employers to hire and train first-time employees effectively.

What is employment linked incentive scheme ?

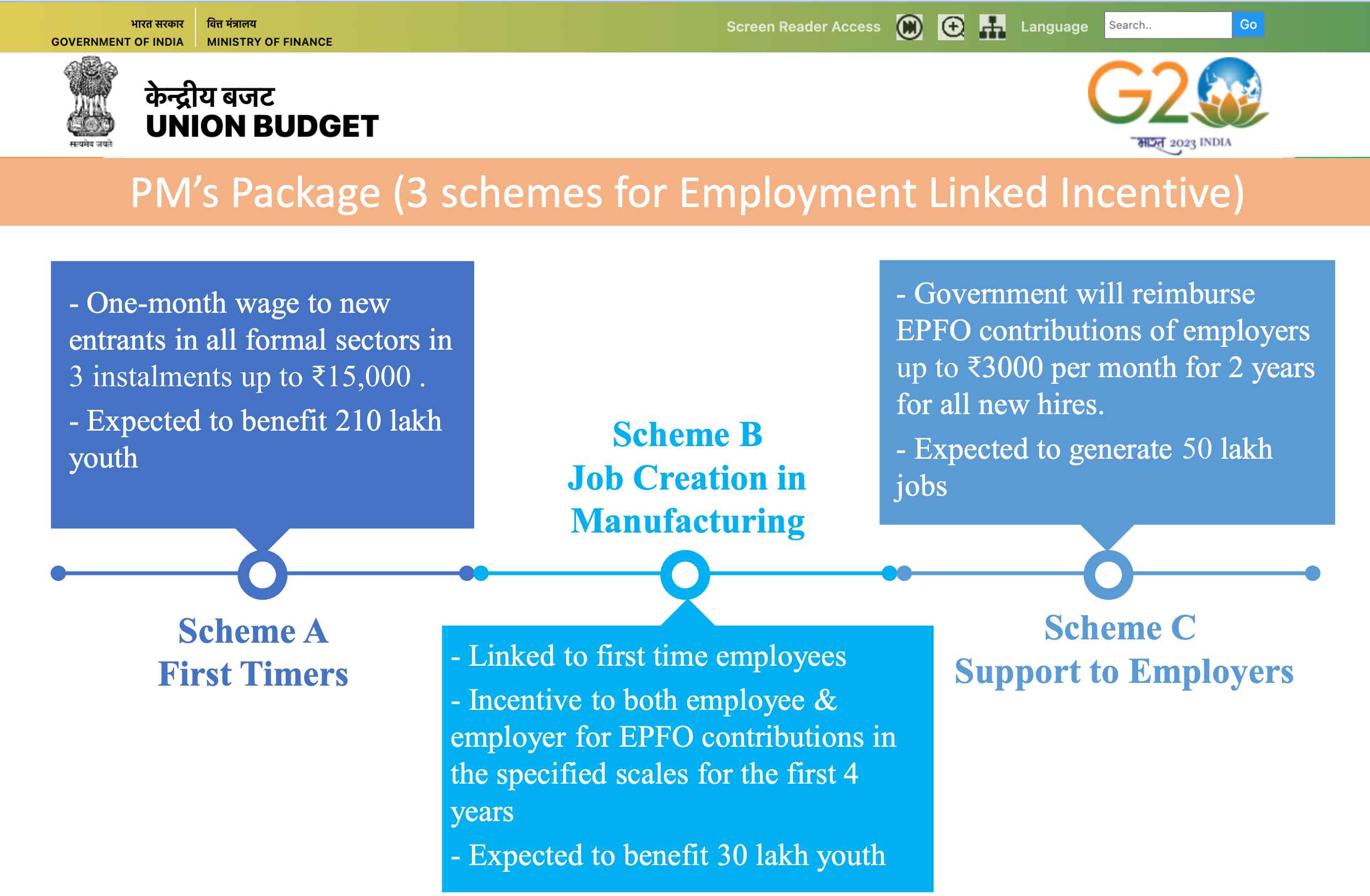

- The Employment Linked Incentive scheme, introduced in Budget 2024, comprises three initiatives aimed at enhancing employment in the formal sector.

- These schemes offer incentives to both employers and newly hired employees who are registered with the EPFO (Employees Provident Fund Organisation).

- The objective is to stimulate hiring activities and promote job creation across various industries.

- Eligible employees receive benefits based on their enrolment in the EPFO, fostering financial security and stability.

- The schemes designed to support economic growth by encouraging employers to expand their workforce and invest in human capital development.

Check Scheme Overview :

- Direct Benefit Transfer : Newly joined employees in the formal sector receive a direct benefit transfer equivalent to one month’s salary.

- Instalment Structure : The subsidy of up to Rs.15,000 is disbursed in three instalments.

- Eligibility : Employees must enrolled in the EPFO and earn a monthly salary of up to Rs.1 lakh.

- Financial Literacy Course : A mandatory online course on Financial Literacy is required before receiving the second instalment.

- Employment Duration : If the employment ends within 12 months, the employer refunds the subsidy to the employee.

- Scheme Duration : Applicable to employees for a period of 2 years after enrolment with the EPFO.

Coverage and estimated outlay of the employment linked incentive scheme :

Impact :

- Boost to Employment : Facilitates increased hiring of first-time employees in the formal sector.

- Skill Enhancement : Supports employee development through financial literacy education.

- Economic Stimulus : Stimulates economic activity by enhancing employment opportunities.

Eligibility for Employers :

- Employee Criteria : Employers must hire either 50 first-time employees or 25% of the baseline number of EPF-covered employees from the previous year, whichever is lower.

- Threshold Maintenance:

- Employers are required to sustain the increased employment level throughout the scheme period.

- Failure to maintain the threshold will result in discontinuation of benefits.

Check Scheme Overview :

Scheme A : First-time Employment Scheme

- Subsidy Details : Provides a subsidy equivalent to one month’s wages, capped at Rs 15,000, for first-time employees earning less than Rs 1 lakh per month. The subsidy is disbursed in three installments.

- Financial Literacy Requirement : Employees must complete a mandatory online Financial Literacy course before receiving the second installment of the subsidy.

- Refund Condition : If employment terminates within 12 months, the employer must refund the subsidy.

- Duration : Applicable for a period of two years.

B Scheme : Job Creation in Manufacturing

- Eligibility Criteria : Open to all corporate and non-corporate employers with a minimum three-year EPFO contribution track record. Employers must hire either 50 new employees or 25% of their current workforce, whichever is higher.

Scheme C : Support to Employers

- Enhanced Workforce Incentive : Supports employers increasing their workforce above baseline levels by at least two employees (for entities with fewer than 50 employees) or five employees (for entities with 50 or more employees).

- Salary Cap :Applicable to employees with salaries not exceeding Rs 1 lakh per month.

- EPFO Contribution Reimbursement : Government reimburses EPFO employer contributions up to Rs 3,000 per month for additional employees hired in the previous year, over a two-year period.

- Scheme Exclusion : Employees covered under Scheme B are not eligible for this benefit.

Job Creation in Manufacturing Scheme in India :

- Objective : The job creation in manufacturing scheme aims to significantly increase employment opportunities for first-time workers in the manufacturing sector.

- Additional Incentive : In addition to the first-time employment scheme subsidy, this initiative offers a structured incentive linked to EPFO contributions over the first four years of employment.

- Incentive Structure : The incentive distributed partially to the employee and partially to the employer based on EPFO contributions made during the initial four years of employment.

- Duration : Employers and employees can benefit from this incentive scheme for a period of six years, promoting sustained job creation and economic growth in the manufacturing sector.

| Year | Incentive (Percentage of wage or salary, shared equally between employer and employee) |

|---|---|

| 1 | 24% |

| 2 | 24% |

| 3 | 16% |

| 4 | 8% |

EPFO Enrolment Requirement in First-time Employment Scheme :

- Mandatory Enrolment : To qualify for the subsidy under the first-time employment scheme. newly hired employees in the formal sector must enrolled with the EPFO (Employees Provident Fund Organisation).

- Subsidy Eligibility : Only employees who have completed EPFO enrolment are eligible to receive a subsidy of up to Rs.15,000, provided in three instalments.

- Scheme Coverage : This scheme applicable to all new employees joining formal sector jobs where EPF benefits are provided by employers.

Click Here to know in detail about all the schemes announced in the financial year 2024 – 2025.

- Employment linked incentive Scheme

- Key Features :

- What is employment linked incentive scheme ?

- Check Scheme Overview :

- Impact :

- Eligibility for Employers :

- Check Scheme Overview :

- Scheme A : First-time Employment Scheme

- B Scheme : Job Creation in Manufacturing

- Scheme C : Support to Employers

- Job Creation in Manufacturing Scheme in India :

- EPFO Enrolment Requirement in First-time Employment Scheme :

ilegu