igrs.ap.gov.in Ec : igrs Ap Prohibited Properties list, Cc Download

IGRS AP Services Key Points :

- Launch : Andhra Pradesh government

- Authority : Inspector General of Revenue and Stamps (IGRS) Andhra Pradesh

- Revenue Collection : Stamp duty, registration charges, transfer duty

- Importance of Registration : Converts documents into public information for easy authentication

- Services: Various IGRS AP services accessible online

- Fees : Stamp duty on property purchases; registration fee for ownership transfer

- Legacy : IGRS AP is the oldest department in Andhra Pradesh for document authenticity

- Website : registration.ap.gov.in

igrs.ap.gov.in Ec : igrs ap prohibited properties list, Cc Download

In order to assist property owners in gathering their data in a single location, the Andhra Pradesh government introduced the Encumbrance Certificate, which is the subject of this article. We will go over how to look for, download, and apply for an encumbrance certificate, as well as the advantages and significance of doing so. A list of services is found on the official registration.ap.gov.in webpage for the Andhra Pradesh IGRS. You can access many IGRS AP services from the comfort of your home by using this portal. The Inspector-General of Revenue and Stamps, or IGRS, is the state body in charge of imposing and collecting taxes connected to real estate.

IGRS AP services :

| Feature | Details |

|---|---|

| Launched By | Andhra Pradesh Government |

| Purpose | To consolidate property-related information for owners |

| Key Functions | |

| Benefits | Valid proof of property ownership |

| Facilitates property transactions | |

| Responsible Authority | Inspector-General of Revenue and Stamps (IGRS) |

| Services Available | Various IGRS AP services accessible online |

| Accessibility | Services can be accessed from the comfort of home |

| Official Website | igrs.ap.gov.in |

IGRS AP : Calculating Stamp Duty

The IGRS AP manages the collection of stamp duty and registration fees in Andhra Pradesh. It offers a stamp duty calculator, helping property owners find their stamp duty amount based on property type, location, and configuration.

Using the Stamp Duty Calculator :

- Visit the IGRS AP website’s homepage.

- Go to the Duty and Fee Details section and select the service type from the dropdown menu.

Available Services include :

- Conveyance

- Gift

- Mortgage (with or without possession)

- Partition

- Release of Benami rights

- Sale of immovable property

- Settlement

- Agreement of sale cum G.P.A.

- Development/construction agreements

- Other cases

After choosing a service, you will see details about the stamp fee, registration fee, and user charges. For instance, selecting “Gift” will show the stamp fee percentage, registration fee, and user charges.

AP Stamps and Registration Charges :

| Document /Instrument | AP Registration Fee | Stamp Duty | User Charges |

|---|---|---|---|

| Sale Deed | 1% | 5% | ₹100 (if value < ₹50,000), ₹200 (if value > ₹50,000) |

| Gift Deed | 0.5% (Min ₹1,000, Max ₹10,000) | 2% of market value | Same as above |

| Agreement of Sale cum G.P.A. | ₹2,000 | 5% | Same as above |

| Sale with Possession | 0.5% | 5% | Same as above |

| Partition | ₹1,000 | 1% | Same as above |

| Settlement Deed | 0.5% | 2% | Same as above |

| Mortgage with Possession | 0.10% | 2% | ₹100 |

| Mortgage without Possession | 0.10% | 0.50% | ₹100 |

- In Andhra Pradesh, the current stamp duty is 5% of the property’s cost, and the registration fee is 1%. Additionally, a transfer duty of 1.5% is imposed by the IGRS AP per the AP Gram Panchayats Act, 1964, and the AP Municipalities Act, 1965.

Documents Needed for Property Registration and AP Stamps :

To register property in Andhra Pradesh, you must provide the following documents :

- Sale Agreement

- Sale Deed

- Encumbrance Certificate (EC)

- Identity Proof for the buyer, seller, and witnesses (options include Aadhaar, Voter ID, Passport, or Driving License)

- Completed Form 60 or PAN card, with proof of identity and address for both parties

- Passport-sized photographs of the buyer and seller

Online Payment Process for AP Stamps and Registration Fees :

To pay for stamps and registration, go to the SHCIL e-Stamp website. There, you can find a list of e-stamping centers in Andhra Pradesh to complete your payment through bank transfer, cheque, or demand draft.

Accessing Citizen Services on IGRS Andhra Pradesh :

- Log in to the SHCL Portal : If you don’t have an account, create a user ID and password.

- Activate Your ID : Sign in once your account is activated.

- Pay Stamp Duty : Click on the ‘Pay Stamp Duty’ tab on the left side of the homepage.

- Select Andhra Pradesh : Choose AP from the dropdown on the e-stamp payment page.

- Self-Print E-Stamp Certificate : Select the type of registration and applicable stamp duty in AP.

- Enter Details and Pay : Fill in the required information and choose your payment method (debit card, net banking, or UPI).

- Print Your E-Stamp Certificate : After the payment is successful, print your e-stamp certificate, which can be verified for authenticity at shcilestamp.com.

Details on Encumbrance Certificate (EC) in IGRS AP :

The Encumbrance Certificate (EC) in Andhra Pradesh contains :

- Owner’s name and property details

- History of documented transactions related to the property

- Information on any home loans or credits used to buy the property

- Details of any gifted or settled deeds

Significance of IGRS AP EC :

The IGRS AP EC is crucial proof of property ownership. Banks usually request the EC as collateral for property loans, confirming the property hasn’t been sold before. If property charges remain unpaid for over three years, the EC must be presented to the Panchayat or Village officer to update land charge records. The EC is also necessary for reclaiming PF and property development.

Conducting the EC Search :

For an EC search using a document number:

- Enter the document number, year of registration, and the SRO office.

- Complete the CAPTCHA and click submit.

For a search using a memo number:

- Provide the memo number, year of registration, and SRO details.

- Fill in the CAPTCHA and submit.

Using the “none” option requires:

- Details like flat number, house number, or apartment along with city and SRO period.

- Complete the CAPTCHA and click submit.

Importance of Stamp Duty :

Stamp duty is a fee charged by the state to home buyers when transferring property titles. The registration fee is a separate charge required for property registration in addition to the stamp duty. It is important to note that stamp duty is based on either the market value or the transaction value of the property, whichever is less.

Stamp Duty on Other Deeds :

| Type of Transaction | Stamp Duty Charges |

|---|---|

| Agreement of Sale cum G.P.A. | 5% |

| Adoption Deed | ₹35 |

| Affidavit | ₹10 |

| Divorce Deed | ₹5 |

| Development Agreement | 5% |

| Construction Agreement | 5% |

| Exchange Deed | 4% on higher value |

| Lease (less than 10 years) | 2% on A.A.R |

| Lease (10-20 years) | 6% on A.A.R |

| Will | Nil |

| Indemnity Bond | 3% (Max ₹100) |

| Special Power of Attorney | ₹20 |

Documents Required for Registration with IGRS AP :

- Gift deeds for immovable property

- Non-testamentary instruments (sale, mortgage, etc.)

- Leases of immovable property

- Contracts for transferring immovable property

Stamp Duty and AP Registration Fees for Wills :

There is no stamp duty for wills; however, a registration fee of ₹100 is applied while the testator is alive. After the testator’s death, a registration fee of ₹100 is required, along with any relevant enquiry and processing fees.

How to Find EC in IGRS AP ?

You can search for the Encumbrance Certificate using these methods :

- Document Number and Year

- House Number or Old House Number (including optional flat number and locality)

- Survey Number in a Revenue Village (possibly with plot number)

Note : Choosing the district and SRO office is mandatory for all three methods.

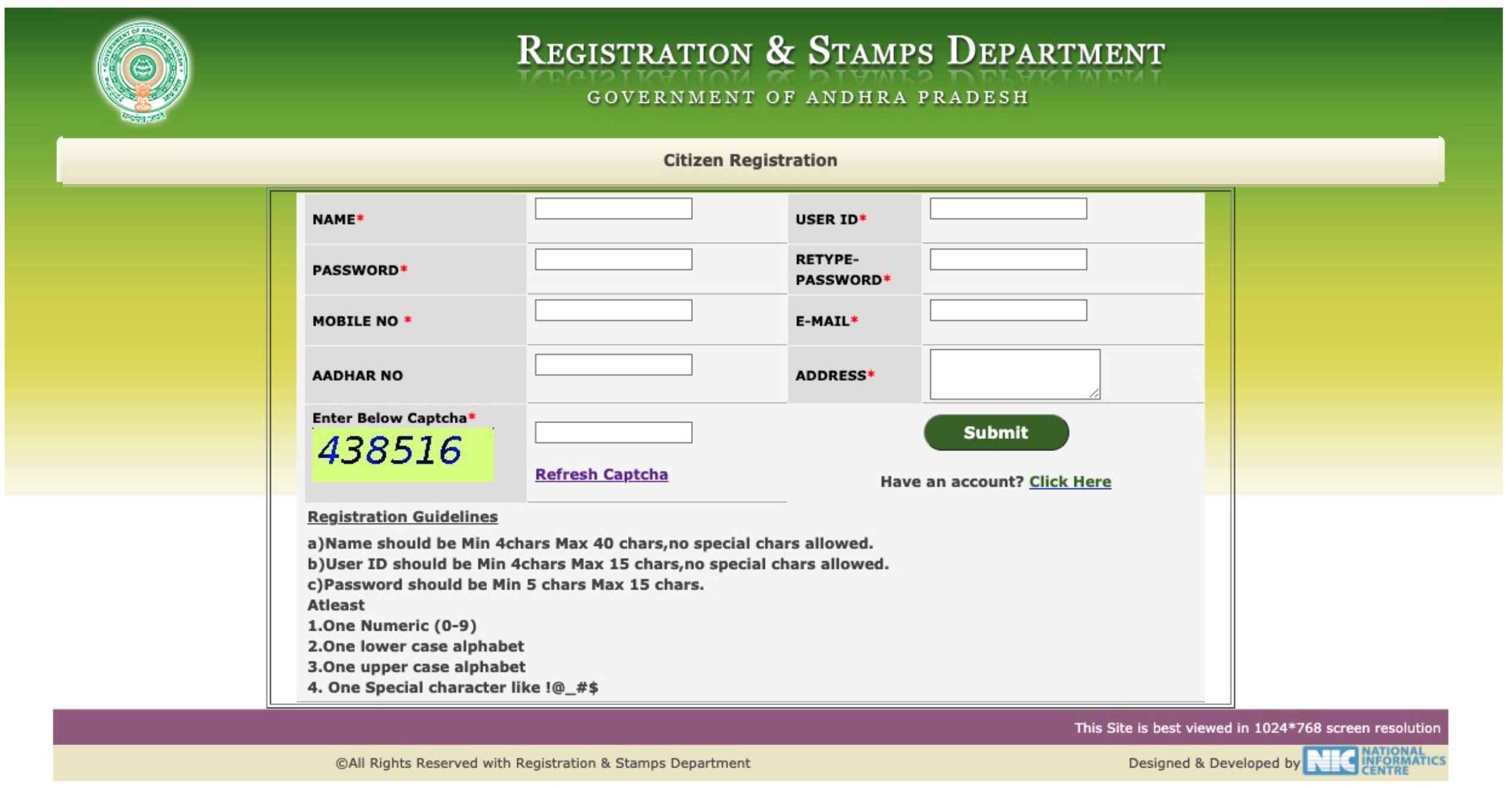

How to Check Your Encumbrance Certificate Online ?

Step 1 : Access the Online EC Option

Visit the IGRS AP website and find the ‘New Initiatives’ section. Click on ‘Online EC’ to start the process of getting your Encumbrance Certificate (EC) online.

Step 2 : Fill in Your Details

You need to provide the following information :

- Name

- Password

- Mobile Number

- Aadhaar Number

- User ID

- Email Address

- Residential Address

Complete the CAPTCHA to move forward with accessing your EC.

Step 3 : Log in with Existing Credentials

If you have a User ID and Password already :

- Skip Step 2.

- Log in using your details and follow the prompts to get your online EC.

How to Download Files from IGRS AP ?

Step 1 : Go to the official IGRS AP EC website.

2nd Step : Fill in Required Details

- District

- SRO (Sub-Registrar Office)

- Registered Document Number

- Registration Year

- CAPTCHA

Step 3 : Submit this information to download your EC.

How to Verify Your Encumbrance Certificate Online ?

Step 1 : Navigate to the Verification Section

Step 2 : Enter Verification Details

Checking IGRS Market Value in AP :

Step 1 : Visit the IGRS AP homepage and find the ‘Market Rates (Basic Rates)’ option on the left.

Step 2 : Choose between Agricultural Land Rates or Non-Agricultural Property Rates and select your District, Village, and Mandal from the dropdown.

Benefits of Online Payments :

- Pay for services from your home.

- Generate challans online without needing to visit the treasury.

- Ensure accurate accounting with minimal errors.

How to Check Your Registration Details ?

Step 1 : Go to the official IGRS AP website.

Step 2 : Click on ‘List of Transactions’ on the right side.

3rd Step : Select the appropriate category (document number, layout plots, or apartments) and enter the required information. Click Submit to see your registration details.

Searching Documents by Name :

Step 1 : Click on ‘Search by Name’ under the services tab on the IGRS AP website.

Step 2 : Fill in the surname, select district, SRO, and other necessary fields, and then click Submit.

Anywhere Registration :

Joint SROs allow property registration across sub-districts within the same jurisdiction. The IGRS AP system supports anywhere registration in 38 registration districts.

Steps to Search for EC on the IGRS AP Portal :

- Visit the AP registration portal at registration.ap.gov.in.

- Go to the EC search feature.

- If the server is busy, consider visiting the local sub-registrar’s office (SRO) or using the Meeseva portal to obtain the EC.

- For EC certificates prior to 1983, contact the SRO at the AP stamps and registration department.

OFFICIAL WEBSITE << igrs.ap.gov.in >> IGRS AP

- IGRS AP Services Key Points :

- igrs.ap.gov.in Ec : igrs ap prohibited properties list, Cc Download

- IGRS AP services :

- IGRS AP : Calculating Stamp Duty

- Using the Stamp Duty Calculator :

- Available Services include :

- AP Stamps and Registration Charges :

- Documents Needed for Property Registration and AP Stamps :

- Online Payment Process for AP Stamps and Registration Fees :

- Accessing Citizen Services on IGRS Andhra Pradesh :

- Details on Encumbrance Certificate (EC) in IGRS AP :

- Significance of IGRS AP EC :

- Conducting the EC Search :

- Importance of Stamp Duty :

- Stamp Duty on Other Deeds :

- Documents Required for Registration with IGRS AP :

- How to Find EC in IGRS AP ?

- How to Check Your Encumbrance Certificate Online ?

- How to Download Files from IGRS AP ?

- How to Verify Your Encumbrance Certificate Online ?

- Checking IGRS Market Value in AP :

- Benefits of Online Payments :

- How to Check Your Registration Details ?

- Searching Documents by Name :

- Anywhere Registration :

- Steps to Search for EC on the IGRS AP Portal :

- OFFICIAL WEBSITE << igrs.ap.gov.in >> IGRS AP