Tan Application Status Check : Apply online, Correction, AO Code, Number Means, Certificate 2024

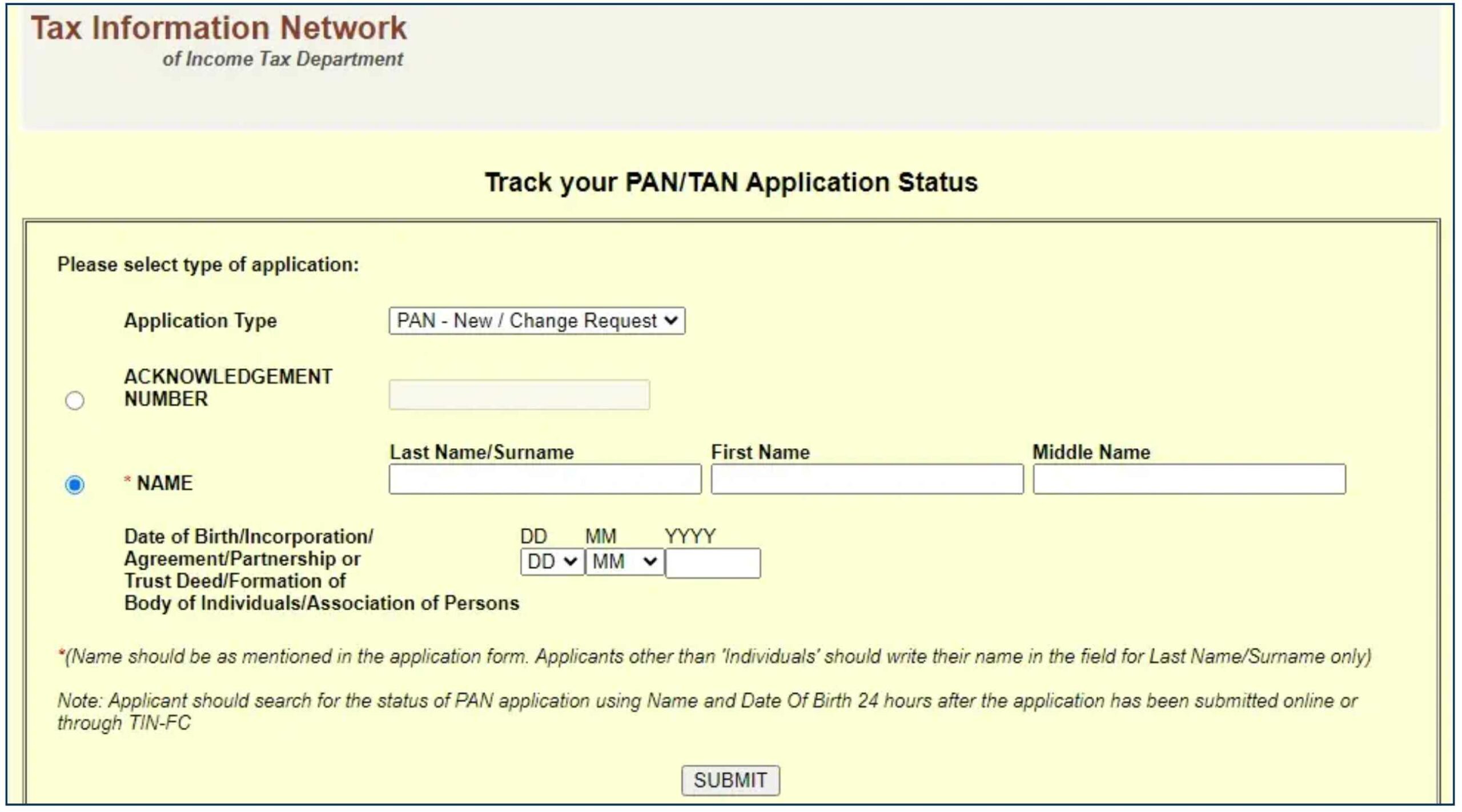

Online Tan Application Status Check

The AO code, short for Assessing Officer code, is a unique identifier linked to each officer who assesses income tax returns based on the taxpayer’s location. This code is vital for businesses and service providers in India, as it is required during the filing of Income Tax Returns (ITRs). A PAN card, necessary for submitting ITRs and engaging in significant transactions like buying property or gold, must feature the AO code. The AO code has four parts: area code, range code, AO number, and AO type.

When applying for a PAN card, applicants must fill in the AO code in the upper right section of the application form, as it is vital for tax assessment. It’s important for all PAN card applicants and taxpayers to understand the AO code’s significance and components.

What is AO Code for PAN Card ?

- Definition : The AO code is an essential part of the PAN card application. It includes the area code, range code, AO number, and AO type, indicating the tax jurisdiction relevant to the applicant.

- Importance : The AO code guarantees that individuals and businesses are taxed according to the appropriate regulations based on their classification and professional category.

AO Code for PAN Card :

| Topic | Summary Points |

|---|---|

| What is TAN ? | 10-digit alphanumeric code. Required for TDS / TCS returns. Mandatory for entities collecting taxes. |

| Why is TAN necessary ? | Unique identification for tax collection / deduction. |

| Required for all TDS / TCS payments. | |

| Penalty of ₹10,000 for non-compliance. | |

| Documents Required for TAN Application | Personal details of the applicant. |

| PAN, digital signature certificate. | |

| Company’s incorporation certificate. | |

| TAN Application Fees and Payment Modes | Application fee of ₹65 + 18% GST. |

| Official Website | tin.tin.nsdl.com |

What is TAN ?

- TAN (Tax Deduction and Collection Account Number) is a unique 10-character code assigned to entities that handle tax deductions on behalf of the Income Tax Department.

- Similar to PAN (Permanent Account Number), which identifies taxpayers, TAN is unique for businesses and entities involved in tax collection.

- TAN is mandatory for submitting both paper and electronic TDS and TCS returns.

- Entities required to deduct tax under the Income Tax Act of 1961 must obtain a TAN, or face penalties of up to INR 10,000.

- Transactions may rejected by banks if TAN is absent on necessary documents.

Significance of Obtaining a TAN Number :

a. Tax Deduction and Collection : Individuals responsible for TDS or TCS must deposit the deducted amount into the treasury on time.

b. Unique Identification : TAN acts as a distinct identifier in all interactions with the tax department, ensuring correct tax credit allocation.

c. Tax Credit Reflection : The deducted tax is credited to the taxpayer and appears on their tax credit statement, 26AS.

Why is TAN Necessary ?

- TAN is critical for entities performing Tax Deduction at Source (TDS).

- It is a 10-character alphanumeric code issued by the Income Tax Department that must used for all TDS and TCS payments, as well as on TDS returns.

- Not obtaining TAN or omitting it on TDS documents can result in penalties of up to INR 10,000.

Types of AO Codes :

1. International Taxation : For businesses and individuals not based in India but seeking a PAN card.

2. Non-International Taxation (Mumbai) : For residents or businesses in Mumbai.

3. Non-International Taxation (Outside Mumbai) : For Indian individuals or businesses outside of Mumbai.

4. Defence Personnel : For members of the Indian Army or Air Force.

Components of AO Code :

| Area Code | Three letters representing the jurisdiction region. |

| Range Code | Identifies the specific ward or circle linked to the applicant’s address. |

| AO Type | Shows the applicant’s category, such as an individual, organization, defense personnel, or non-resident. |

| AO Number | A unique number assigned to the Assessing Officer. |

Determining the AO Code :

a. For income other than salary, the AO code is based on the applicant’s home address.

b. For salary income or a combination with business income, it relies on the official address.

c. For entities like HUF, LLP, partnerships, and trusts, the AO code is based on the office address.

How to Migrate PAN Card AO Code ?

- Write to your current AO, explaining the need for a change due to a new address.

- Submit an application to the new AO, requesting the necessary adjustments with the existing AO.

- The current AO must approve the request.

- The approved application is sent to the Income Tax Commissioner.

- Once the Commissioner approves, the AO code is officially changed.

TAN Number Format :

TAN consists of a 10-character combination – ABCD12345X.

The first four characters are letters, the following five are numbers, and the last character is a letter.

The first three letters indicate the city where the TAN is issued.

The fourth letter represents the initial of the individual’s name.

The numbers and final letter are generated by the system.

To find your Jurisdictional Assessing Officer (AO) :

Follow these steps :

- Go to the Income Tax Department’s PAN portal at www.incometax.gov.in/iec/foportal.

- Click on “Know Your AO” to access a new page.

- Enter your PAN number and registered mobile number. You will receive an OTP on your mobile. Enter that OTP and submit it to see your Jurisdictional AO details.

- After completion, your AO information will appear on the screen.

Understanding the AO Code :

The AO code is based on your address and taxpayer type, with different criteria for individuals and non-individuals:

For Individuals :

- If your income is only from salary or a mix of salary and business income, your AO code is linked to your registered area and residential address.

- If you have other earnings outside of salary, the code is based on your home address.

For Non-Individuals :

- For entities like Hindu Undivided Families (HUFs), organizations, partnership firms, LLPs, or associations, the AO code is determined by the business address.

Migrating Your AO Code :

If you need to change your AO code due to a move, follow these steps :

- Find Your New AO Jurisdiction : Check the tax jurisdiction for your new location on the Income Tax Department’s website or ask your local tax office.

- Collect Necessary Documents :

- Valid PAN card

- Proof of new address (like an Aadhaar card, voter ID, or utility bill)

- Proof of changes in income source (such as a salary slip or business registration)

- Choose Your Migration Method: You can migrate online through the e-filing portal or offline with Form 49A.

A) Online Method :

- Visit the Income Tax Department’s e-filing portal at incometax.gov.in/iec/foportal/ and log in using your PAN and password.

- Navigate to “My Account” and choose “Update PAN Card Details.”

- Input your new address and select “Change of AO.”

- From the drop-down menu, choose your new AO jurisdiction and submit the form electronically with a digital signature.

B) Offline Method :

- Download Form 49A from the Income Tax Department’s website or get it from your local tax office.

- Complete the form with your PAN, old and new addresses, and reason for migration.

- Submit the filled form along with proof of address and new jurisdiction to the nearest PAN Service Centre or Income Tax office.

TAN Application Fees and Payment Modes :

The application fee is INR 77, which includes GST and other charges.

Payment methods include :

- Cheque

- Demand draft (payable to NSDL-TIN in Mumbai)

- Credit card

- Debit card

- Net banking

Exceptions apply for state and central governments, as well as statutory and autonomous bodies, which cannot use credit/debit cards or net banking for payments.

Documents Required for TAN Application :

1. Personal details including name, address, and phone number of the applicant.

2. PAN of the individual or entity.

3. Digital signature certificate of the designated person for the company.

4. Certificate of incorporation for companies.

5. Information about the person responsible for tax matters.

6. For online applications, a printout of the acknowledgment number must sent to the Income Tax Department.

OFFICIAL WEBSITE << tin.tin.nsdl.com >> Tan Application

CLICK HERE – to check your TAN AO search.

- Online Tan Application Status Check

- What is AO Code for PAN Card ?

- AO Code for PAN Card :

- What is TAN ?

- Significance of Obtaining a TAN Number :

- Why is TAN Necessary ?

- Types of AO Codes :

- Components of AO Code :

- Determining the AO Code :

- How to Migrate PAN Card AO Code ?

- TAN Number Format :

- To find your Jurisdictional Assessing Officer (AO) :

- Follow these steps :

- Understanding the AO Code :

- For Individuals :

- For Non-Individuals :

- Migrating Your AO Code :

- TAN Application Fees and Payment Modes :

- Documents Required for TAN Application :

- How to Know Your Jurisdictional AO ?

- OFFICIAL WEBSITE << tin.tin.nsdl.com >> Tan Application