Check Ptec Registration Portal : mahavat.gov.in Mahagst Ptec Payment, Challan, Certificate

Ptec Registration : mahavat.gov.in Mahagst Ptec Payment, Challan, Certificate

In Maharashtra, it is mandatory to complete PTEC (Professional Tax Enrollment Certificate) registration under the Maharashtra Profession Tax Act for conducting any type of business or profession. Additionally, the PTEC tax payment must be made annually via a PTEC challan. Apart from partnership firms and Hindu Undivided Families (HUFs), every individual engaged in any profession, trade, occupation, or employment in Maharashtra—including proprietors, partners in firms, directors in companies, members of HUFs, LLPs, companies, or trusts—must obtain a Profession Tax Enrollment Certificate (PTEC) under the Maharashtra Profession Tax Act. They are also required to pay the profession tax annually at the prescribed rate. In this article lets explore how to proceed with PTEC registration and online challan payment in Maharashtra.

Services Available on MAHAGST :

Due date for payment of PTEC :

| Enrollment Date | Due Date for Payment of PTEC |

|---|---|

| Enrolled on or before 31st May | Before 30th June of the same financial year |

| Enrolled after 31st May | Within one month from the date of enrollment |

- Example : For the Financial Year 2022-23, if a person is registered before 31st May 2022, the PTEC should be paid on or before 30th June 2022.

Who is Required to Pay PTEC ?

- Individuals : All individuals engaged in business or profession must pay PTEC.

- Hindu Undivided Family (HUF) : HUFs involved in business or profession are required to pay PTEC.

- Companies and Entities :

- Private Limited Companies

- Public Limited Companies

- One Person Companies (OPC)

- Firms

- Limited Liability Partnerships (LLP)

- Co-operative Societies

- Associations of Persons (AOP) and Bodies of Individuals (BOI), whether incorporated or not

- For Salaried Persons : PTEC is typically deducted from their salary by the employer.

Interest and Penalty for Non-Payment of PTEC :

| Type | Details |

|---|---|

| Interest Rates | – 1.25% per month for the first month – 1.5% per month for the next two months – 2% per month thereafter |

| Penalty | – 10% of the amount owed for delayed payment |

| Delay in Certificate | – Rs. 2 per day for delay in obtaining the PTEC Certificate |

PTEC Registration Online in Maharashtra :

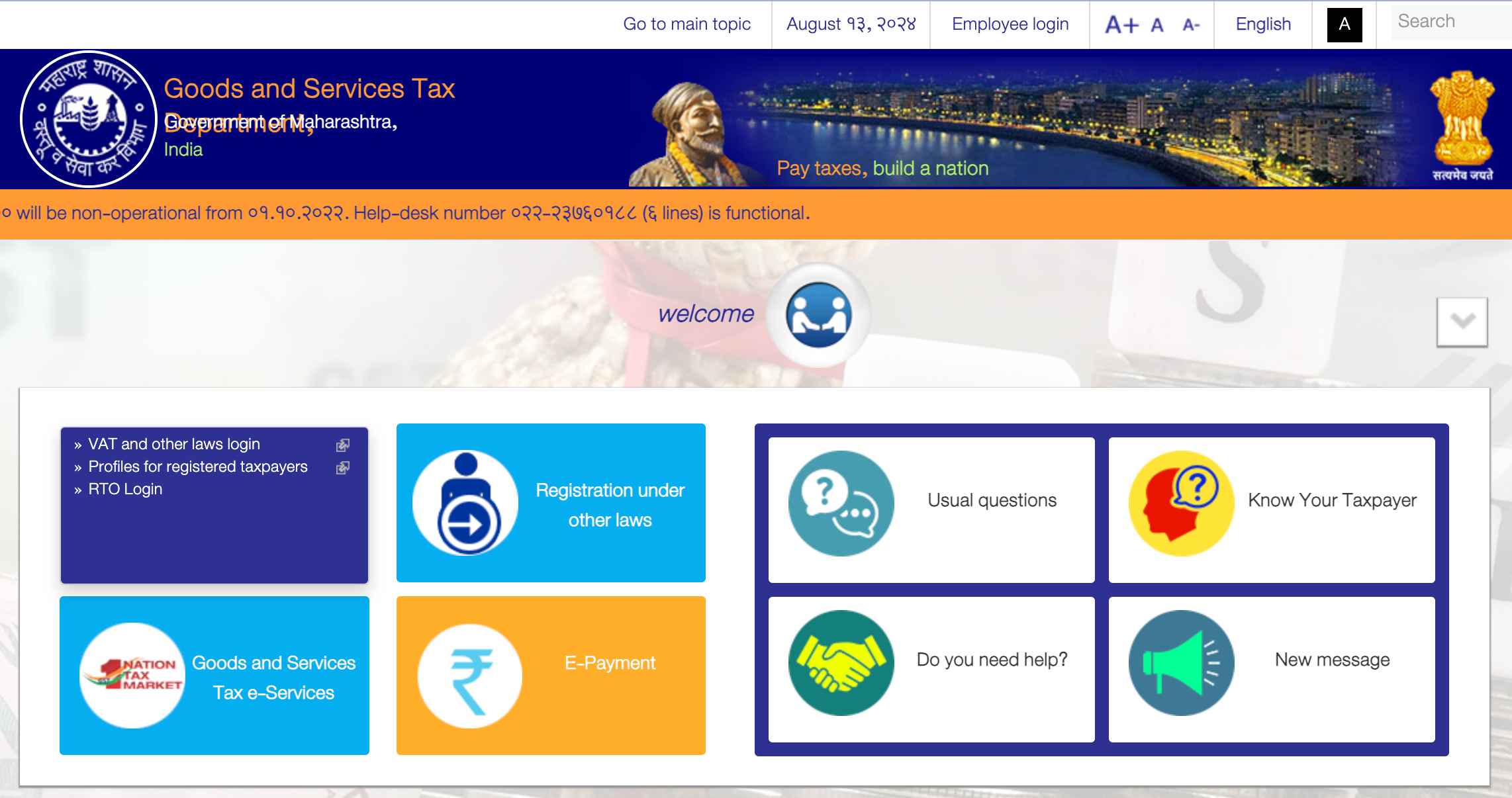

- Visit the Portal : Go to the official Maharashtra GST portal : mahagst.gov.in.

- Navigate to PTEC Enrolment : On the home page, select Other Acts Registration. Choose New Dealer Registration.

- Begin New Registration : Click on New Registration under Various Acts and then click Next.

- Select Dealer Type : Tick New Dealer and proceed by clicking Next.

- Validate PAN /TAN : Validate your PAN or TAN as required.

- Create Temporary Profile : Enter your valid PAN, email ID, and mobile number to create a temporary profile. Click on the link sent to your email and enter the OTP received on your mobile to validate. Create your user ID and password.

- Log In : On the home page, select Log in for e-services. Choose Log in for VAT & Allied Acts. Log in using your PAN as the user ID and the password you created.

- Access e-Services : Go to e-Services > Registration > New Registration.

- Select PTEC Act : Choose the PTEC Act from the list.

- Complete the Application : The e-application (Form I/II) under the Professional Act will appear. Fill in all required details accurately.

- Submit the Form : Click on the Submit button. After successful submission, an acknowledgment will be displayed. Save this acknowledgment to track your application status.

Documents Required for PTEC Registration in Maharashtra :

- PAN Card : Required for identification.

- Residential Address : Proof of where you live.

- Office Address : Details of your business location.

- Bank Account Details : Information about your bank account.

- Business /Profession Commencement Date : The start date of your business or profession.

- PTEC Applicability Date : The date from which PTEC applies.

- Valid Mobile Number : For communication purposes.

- Valid Email ID : For registration and correspondence.

How to Find PTEC Number in Maharashtra ?

- Visit the Portal : Go to mahagst.gov.in.

- Navigate to PTEC Details : On the home page, select Other Acts Registration. Click on RC Download.

- Enter PAN /TIN : Enter your PAN or TIN number to retrieve your PTEC number.

Who is Exempted from Maharashtra PTEC ?

- Members of Armed Forces : Members defined under the Army Act, 1950; Air Force Act, 1950; and Navy Act, 1957.

- Textile Industry Workers : Migrant workers in the textile industry.

- Persons with Permanent Physical Disabilities : Individuals suffering from permanent physical disabilities, including blindness.

- Women Agents : Women working as agents under the Small Savings Directorate’s women-centric regional savings schemes.

- Individuals with Intellectual Disabilities : Persons with intellectual and developmental disabilities (including mental retardation).

- Senior Citizens : Individuals who have completed the age of 65 years.

- Parents or Guardians : Parents or guardians of children with physical disabilities.

- Central Reserve Police Force (CRPF) Members : Armed members of CRPF, governed by the Central Reserve Police Force Act, 1949, and members of the Border Security Force (BSF), governed by the Border Security Force Act, 1968.

Interest on late payment of PTEC Challan :

How to Download PTEC Certificate in Maharashtra ?

- Visit the Portal : Go to mahagst.gov.in.

- Navigate to PTEC Certificate Download : On the home page, select Other Acts Registration. Click on RC Download.

- Enter Details : On the next page, enter your PAN/TIN number. Click Get Status.

- Download the Certificate : The PTEC certificate will be displayed. Click Download to save the certificate.

OFFICIAL WEBSITE >> mahagst.gov.in >> PTEC Registration Online – Maharashtra

CLICK HERE – to access the PTEC Registration Online – Maharashtra

- Ptec Registration : mahavat.gov.in Mahagst Ptec Payment, Challan, Certificate

- Services Available on MAHAGST :

- What is PTEC ?

- Due date for payment of PTEC :

- Who is Required to Pay PTEC ?

- Interest and Penalty for Non-Payment of PTEC :

- PTEC Registration Online in Maharashtra :

- Documents Required for PTEC Registration in Maharashtra :

- How to Find PTEC Number in Maharashtra ?

- Who is Exempted from Maharashtra PTEC ?

- Interest on late payment of PTEC Challan :

- How to Download PTEC Certificate in Maharashtra ?

- OFFICIAL WEBSITE >> mahagst.gov.in >> PTEC Registration Online – Maharashtra