Official Notification 2025 : Whatsapp Channel

Join Now

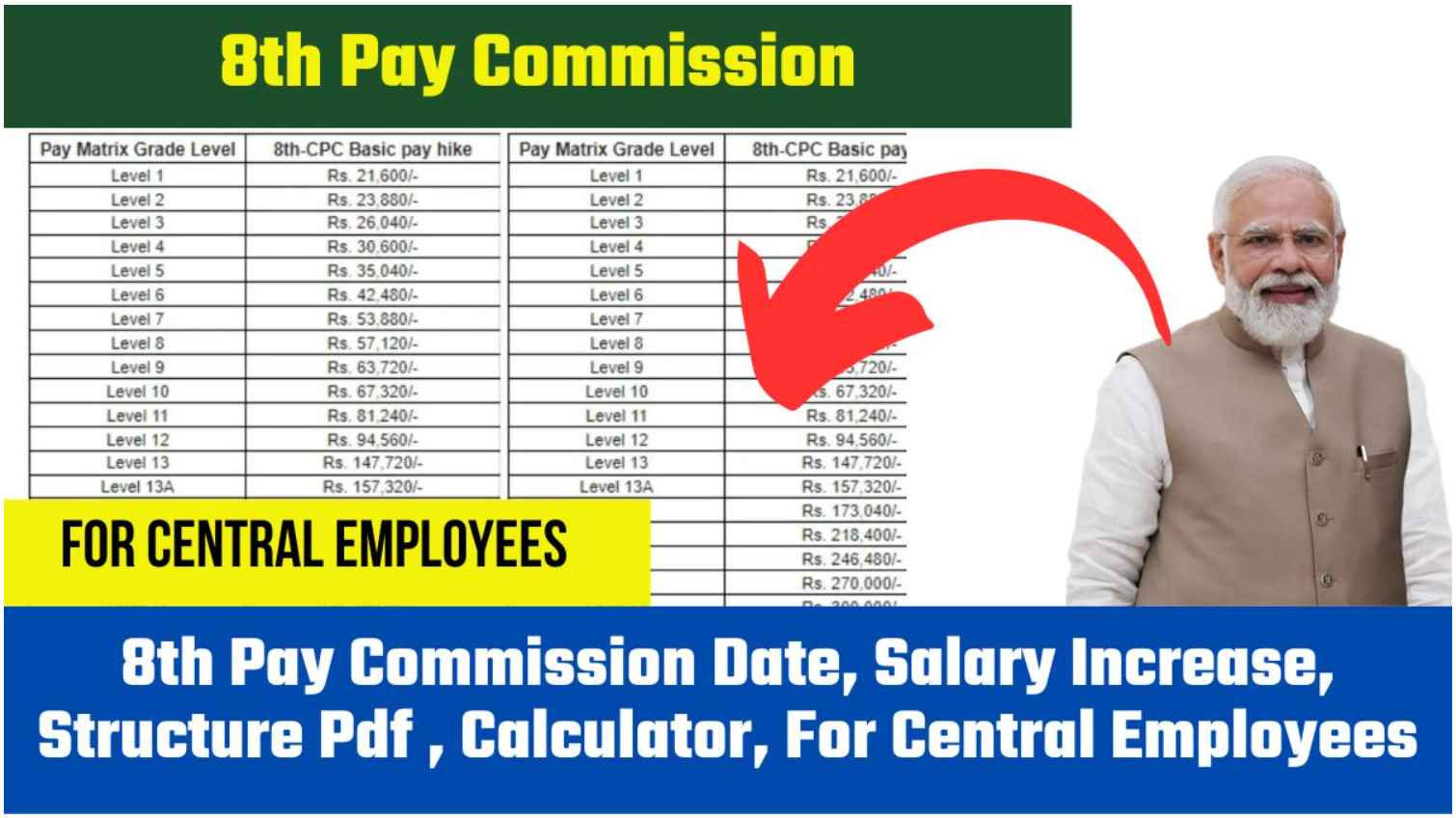

Check 8th Pay Commission Date, Salary Structure pdf, Salary slab, Fitment Factor, Calculator, Pay Matrix

8th pay commission Date 2024 2025

Brief Overview of the 8th Pay Commission :

| Name | 8th Pay Commission |

|---|---|

| Draft Created in the Year | 2023 |

| Announcement of Commission | 2024 (speculated) |

| Year of Implementation | 2026 |

| Initiated by | Central Government of India |

| Classification of the Commission | Finance |

| Beneficiaries | Central Government Employees |

What is the 8th Pay Commission ?

8th Pay Commission Benefits :

8th Pay Commission is expected to bring several benefits to government employees and positively impact the Indian economy. Here are the anticipated benefits :

- Increased Salaries : Basic salaries are expected to increase by approximately 20% to 35%, enhancing the take-home pay for central government employees and ensuring better living conditions and financial stability.

- Enhanced Allowances : Allowances such as House Rent Allowance (HRA), Transport Allowance (TA), and Dearness Allowance (DA) might adjusted to reflect inflation and the changing cost of living.

- Boost Spending : With higher disposable incomes, government employees may increase their spending, thereby boosting the economy through higher demand for goods and services.

- Improved Retirement Benefits : Pension enhancements of up to 30% can provide better financial security post-retirement.

- Increased Tax Revenue : Higher salaries may lead to increased tax revenue for the government.

- Decreased Financial Strain : Enhanced financial stability among employees can lead to improved social stability and a reduced reliance on social welfare programs.

- Talent Attraction and Retention : Competitive compensation packages could make government jobs more attractive to skilled professionals, aiding in talent acquisition and retention.

8th Pay Commission Salary Slab :

- As discussions about the 8th Pay Commission gain momentum, social media is abuzz with questions regarding the expected salary increases and the fitment factor that will used to revise salaries.

- The increase in salary will largely depend on the fitment factor and the minimum pay increase.

8th Pay Commission Pay Matrix and Fitment Factor :

- The fitment factor is crucial as it is used to determine the revised salary and pay matrix under the 8th Pay Commission.

- This factor helps align the current 7th CPC pay scale with the new 8th CPC pay scale.

Seventh Pay Commission Fitment Factor :

- The 7th Pay Commission established a uniform multiplication factor of 2.57 to revise the 6th CPC pay to the 7th CPC pay scale.

- A new pay matrix format was introduced to simplify pay fixation calculations during promotions and annual increments.

Fitment Factors Used in 7th CPC :

- The 7th CPC utilized multiple fitment factors: 2.57, 2.62, 2.67, 2.72, 2.78, and 2.81.

- These different fitment factors were applied to various pay levels to enhance pay differentiation between PB1, PB2, PB3, and PB4 pay scales.

Justification for Different Fitment Factors :

- The 7th Pay Commission used different fitment factors to rationalise pay according to the classification of posts.

- This approach was adopted to ensure a fair enhancement in pay across different pay scales, achieving rationalisation as per the classification of posts in the 7th CPC.

OFFICIAL WEBSITE >> 8th Pay Commission Date >> Check here

- 8th pay commission Date 2024 2025

- What is the 8th Pay Commission ?

- 8th Pay Commission Benefits :

- Pay Matrix Table for the 8th Pay Commission :

- 8th Pay Commission Salary Slab :

- 8th Pay Commission Pay Matrix and Fitment Factor :

- Seventh Pay Commission Fitment Factor :

- Fitment Factors Used in 7th CPC :

- Justification for Different Fitment Factors :

- How the 8th Pay Commission Fitment Factor Can Determined ?

- a) Calculation of 8th CPC Minimum Pay :

- b) Dearness Allowance Rate Applicable from January 1, 2026 :

- OFFICIAL WEBSITE >> 8th Pay Commission Date >> Check here

Yes I am interested in this Soo what is the next step

When Central Government denying 8 th CPC then on what basic you are speeding such fake information